1ABB India, Bengaluru, Karnataka, India

1SGT University, Gurugram, Haryana, India

1Information Systems and Business Analytics Department, College of Business Administration, California State University, Sacramento, California, United States

Fintech is here to stay, like the tech revolution with far-reaching impact on different sectors. Fintech’s potential to transform the Banking, Financial Services, and Insurance (BFSI) sector has been evident since its inception. As fintech grew, product offerings kept increasing. The ease of transaction and speed of transaction lured many to switch to fintech offerings. Thus, numerous studies were done to check if fintech had redefined the product range in the BFSI sector. There was a gap wherein not many studies identified the direction of fintech with regard to products. The existing study scans the extensive literature to unveil different clusters which have emerged out of fintech research. A literature review was done for 1,321 articles by applying topic modelling, a machine learning technique. The abstracts of these documents were analysed by applying the latent Dirichlet allocation statistical method. The resultant keywords that emerged were manually analysed to identify the categories/topics of study based on relevance. Seven key categories emerged based on the analysis of the results of topic modelling being fintech, blockchain, digital banking, crowdfunding, algo tech, regulatory technology and sustainable finance. The findings of this study would be beneficial to understand how fintech is shaping contemporary venues for future research. The article suggests a technical approach to provide valuable information to practitioners for fintech applications and to academicians for future research.

Corporate, government and governance, industry, policy, professionals, RegTech, fintech and emerging verticals, effects of fintech, growth of fintech, fintech

Introduction

Ever since business and commerce started to grow, the mobilisation of funds has been the prime responsibility of the banking sector, but recently, the focus has shifted to fintech. The financial world post-pandemic emerged very different, and the biggest change which happened was that dependence on brick-and-mortar banking infrastructure was reduced. With cashless transactions, microfinance and online trading, the fintech sector mushroomed big time, as it offered convenience, low cost and accessibility of digital platforms to facilitate these transactions. As per the Financial Stability Board, fintech is ‘technologically enabled financial innovation that could result in new business models, applications, processes, or products with an associated material effect on financial markets and institutions and the provision of financial services’.

The growth of fintech was welcomed as more and more start-ups signed up, transactions moved faster, physical wallets were replaced by digital wallets as cashless transactions became popular, financial inclusion was possible, companies looked at alternate ways of financing than the traditional instruments, and cryptocurrencies could be launched, which eliminated geographical barriers. Fintech supplemented and replaced core banking transactions like small payments, which are now being done through mobile wallets and payment gateways using digital applications on smartphones (Stulz, 2022). In the last decade, there has been a significant adaptation of digital payment platforms. For example, in India, the inclination towards a cashless economy and the push towards demonetisation and the Covid provided impetus to the growth of fintech.

Fintech could be understood to be an advanced version of internet banking, but the product offerings clearly indicate that it is a necessary technology for the banking sector in the developed ecosystem. Important verticals emerging in the fintech are RegTech, Proptech, Wealthtech, Insurtech and the most important blockchain technology. Mobile payments and digital wallets, an outcome of fintech, have impacted banks somewhat positively (Anshari et al., 2020). A more recent outcome is the achievement of economic growth through financial inclusion. Fintech innovations can prove to be a game changer in this direction.

Literature Review

Fintech-enabled solutions and innovative business models from the combination of finance and technology (Jagtiani & Lemieux, 2018). It streamlines financial services and offers efficiency and convenience. Fintech has gained popularity in both developed and developing nations as the integration between information communication and technology and finance (Buckley et al., 2019). Fintech offers cost savings and maximises profits in operations. Fintech implies innovative business models that would transform the financial services industry (Mhlanga, 2020). Computational risk management, big data analytics and electronic stock trading have increased the efficiency and effectiveness of financial services (Holmes & King, 2019). Fintech innovations offer new value-added services and improve efficiency (Takeda & Ito, 2021). Various aspects of fintech include financial inclusion, bank marketing, P2P lending, crowdfunding and RegTech. Fintech lending includes peer-to-peer lending platforms that facilitate direct borrowing and lending between individuals, bypassing traditional financial intermediaries (Bollaert et al., 2021). Fintech technologies can improve access to finance by reducing information asymmetry, agency problems and difficulties in allocating residual control rights.

The global financial crisis triggered the growth of fintech (Anshari et al., 2020). It was predicted that technological power would prove to be a core competency for financial institutions in the future (Chen et al., 2017), which was proven by fintech. Fintech products challenge products of conventional banking (Butt & Khan, 2019) and cover a wide spectrum of products like peer-to-peer (P2P) lending (Hendrikse et al., 2020) and cryptocurrencies blockchain technology (Nakamoto, 2008). Fintech represents a disruption in the financial sector due to the intertwining of ICT and automatic processing (Sibanda et al., 2020). As per Thakor (2020), fintech bypasses traditional intermediaries in banking in its offering of financial services. As the internet environment gets mature, the lack of physical banking is not perceived as a problem (Tatuev et al., 2020). Also, with peer-to-peer lending, which directly matches lenders and borrowers, fintechs are putting more pressure on policymakers and supervisors (Vucinic, 2020).

Fintech is a disintermediation force with disruptive technologies as the drivers, which resulted in a technological change in raising, allocating and transferring capital (Das, 2019). Fintech disruptions are assertively cutting the bank’s service delivery chain, resulting in clients getting a higher value proposition. The banking sector is undergoing transformation in its fundamental system due to digital transformation (Drasch et al., 2018). The financial industry, which was considered relatively conservative, changed rapidly due to the advent of innovative financial services such as internet-only banks (Lee & Kim, 2020; Vives, 2019). Internet-only banks are platforms of fintech services widely compatible with not only financial services but also diversification of services such as messenger, shopping and media (Rafay, 2019). Though fintech evolved in phases, this technology has enabled banking services to evolve from ‘ATM’ to ‘Any time availability’. Fintech grew fast, and the pace was phenomenal, which resulted in challenges to practitioners on relevant insights for quite some time but a relief to customers on many fronts.

Advances in technology, such as Gen artificial intelligence (AI), machine learning (ML), ChatGPT and immersive technologies, are challenging traditional intelligence on ways to interact and offer products/services to customers (Coetzee, 2018). There is a positive as well as negative outlook on financial innovation (Athique, 2019). The positive one is that it improves efficiency or performance, and the new services would increase transaction speed for the customer and opportunities for growth for banks and fintech companies. The negative one is that the regulatory ecosystem might get compromised as there are no stringent rules governing this growth; hence, it increases risk. Nevertheless, the popularity of fintech is evident by the fact that seed funding and VC investment in fintech have been rising steadily in the past decade. There are a few challenges too in the process. Cybersecurity and protection of private client information is a critical regulatory point, but this information about the clients is vital for fintech companies to study patterns and establish trends using big data thereafter to offer technology-based solutions to the general masses. When information is not protected by regulatory decrees, trust gets eroded and contributes to systemic risk (Coetzee, 2018). Regulations like the General Data Protection Regulation in the West and the Digital Personal Data Protection (DPDP) 2023 in some countries, like India, provide a framework to safeguard clients’ private data against cybercrimes.

Fintech formation happens in economies where access to loans is more difficult. The country’s gross domestic product and a less developed banking system provide impetus to the growth of fintech, more specifically in the field of credit (Hommel & Bican, 2020). Although fintech lending has started to transform the way businesses secure finance, with non-bank lenders growing rapidly, the volume of lending is not as high as traditional banks (Jagtiani & Lemieux, 2018).

While BIS and the Financial Stability Institute proposed a systematisation splitting the fintech environment into three parts—fintech activities, enabling technologies and enabling policies—but it was difficult to identify the direction in which fintech academic research was heading and the important verticals which needed to be studied. This study is an attempt to classify the research in clear verticals which have emerged in the past few years using topic modelling (TM).

Methodology

The use of TM technique for topic discovery has increased in order to manage the vast amount of data to be studied. Service industries such as banks need to record all data related to customer interaction, such as transactions, enquiries, feedback, reviews enquiries, feedback, reviews and interests, to help the organisations to target their resources and services effectively. TM is also an important technique for many applications such as sentiment analysis (Dandala et al.,2019). Recommendation include systems to extract user preference (Pennacchiotti & Gurumurthy, 2011), document summarisation to summarise a vast amount of text into concise format (Wang et al., 2009), topic discovery in a chat box system (Tepper et al., 2018) and fake news detection (Sabeeh et al., 2021). Therefore, TM is effectively utilised in several application domains like healthcare, online learning, spam detection and document analysis to discover the underlying topic.

TM technique uses statistical algorithms to discover the semantic structures that define a topic, in the text content under study. It works on the principle that normally a cluster of words that are similar or related and a set of expressions often occur together to describe the focus or topic of interest of the text. The words that contribute to identifying the topic are called ‘keywords’. TM technique searches and identifies these ‘keywords’ and their relative strength of presence to discover the hidden ‘topic’ or ‘topics’ (Cogitotech, 2021).

A trend analysis of literature related to fintech in the past two decades shows a steady increase in research, awareness and interest in this domain (Figure 1).

Figure 1. Chart Showing the Number of Studies Done Over the Years.

This article uses TM to analyse the applicability of fintech in various domains by evaluating the extant literature and discovering the most common areas/domains/segments which emerge out of the study. The research articles for the study were sourced from various acclaimed databases that publish original and new works, academic research papers and review articles, such as Web of Science, ProQuest, Science Direct, Academic Search Complete, IEEE Explore and Association for Computing Machinery. These publications are some of the most popular, well-known and trusted original research paper publishers in the fields of technology, banking and finance. The research articles were searched with the keyword ‘fintech’ and were shortlisted from the databases from 1998 to 2022. A total of 5,880 articles were identified. Thereafter through a manual review process, irrelevant articles were excluded, such as duplicates, editorials, non-English, review papers and not related to journals. The manual view process is important to clean the data and filter unwanted articles before TM can be run. This resulted in 1,372 articles matching the given keyword criteria. From this pool, only journal and conference articles were retained. After filtering, 1,321 articles were found suitable for the next step.

Topic model is a statistical method used in ML techniques to find or discover set of hidden or latent ‘topics’ in a collection of documents. TM works on the principle that a document under study focuses on a single or related topic based on a set of related keywords/semantics. TM is an unsupervised technique and an exploratory work, since it works on an input that is completely new to it (as opposed to a supervised technique that works on data that are already provided to it), identifies an optimal number of topics and optimal number of words that contribute to each topic. It finds a number of ‘clusters’ or ‘groups’ of topics in the literature that are more similar to each other. Several input parameters, such as corpus of words, sample number of topics, number of iterations and number of words, are provided to the TM technique, using which it iterates over the given corpus of text to identify the hidden latent topics.

There are several techniques of TM, such as latent semantic analysis (LSA), latent Dirichlet allocation (LDA) and non-negative matrix factorisation (NMF) (Appendix A). While LSA captures hidden concepts or topics in a document corpus by leveraging context around words, the algorithm uses a term frequency–inverse document frequency (TF-IDF) matrix for analysing documents. Hence, rare words contribute more weight to the model. Therefore, the model helps to identify ‘incoherent’ topics in a corpus. The LDA technique assumes each document as a mix of many topics and each topic as a mix of many words. LDA starts work from documents to identify topics that would have generated those documents and the set of words that would have generated those topics, in a reverse iterative way. In addition, the NMF technique also uses term–document matrix to generate a set of topics. The NMF technique reduces the dimension of the input corpus and gives relative weightage to words that have less coherence. The NMF method is also good in extracting sparse and incoherent topics from the documents.

Each of these techniques was applied to the article repository under study, and the output generated was assessed to identify the technique that is more suitable for the study. After studying the outputs generated by each TM technique, the LDA technique was chosen as it was more consistent in the topics generated.

Detailed Steps

For applying the TM technique, the ‘abstract’ section of articles was used since the abstract provides a summary of the article, whereas using the complete article would have provided a lot of detailed text as an input corpus, resulting in repetitive content for processing. The additional step of reviewing abstracts adds significant value to bibliometric analysis by enhancing the precision, reliability and interpretability of the findings. While keyword search provides an initial filter, abstract reviews ensure that the final dataset is robust and accurately represents the research landscape.

Data cleaning was done using pre-processing techniques to remove noisy data, that is, which is unnecessary and does not provide useful inputs to the TM programme. To remove noisy data, first, the entire input corpus or text was converted into lower case to standardise them. Thereafter, special characters, digits and stop words (such as prepositions and articles) were removed. The next step was ‘lemmatization’, where each word was reduced to its root word. This step is useful as it helps to remove the plural word forms and inflectional endings of words and retains only the root or base form of the words.

Prior to pre-processing, the entire text was broken down into individual words, called ‘tokens’ by a method called ‘count vectorization’, used by the TM technique. Vector representation of tokens helps in identifying the most repeated words, relationship between the words, as well as uncovering the most similar group of words and topics.

To identify the optimal number of topics, along with the number of words, the number of topics and other parameters, the data were analysed by applying bigrams and trigrams. Based on the output of the model, it was observed that bigrams provided the best results with an optimal number of topics and keywords. Accordingly, bigram was applied to the abstracts under analysis, along with the number of topics, keywords and other parameters to the topic analysis.

After pre-processing the text, a TM programme was created using the LDA technique using the Gensim library. This library provides prebuilt functions with algorithms to process the given text data, which generates a set of ‘topics’, keywords contributing to the topics and the percentage of how each keyword contributes to the given topic. Measures such as perplexity, coherence scores and topic visualisation were used to evaluate the generated topic models. Coherence score is a measure of the relative distance between words in a topic. The average distance between words is calculated as the overall coherence score of a topic. This score is calculated by building many models with different numbers of topics. The model with the highest coherence score has the optimal number of topics.

To find the optimal number of topics, the topic model algorithm was executed with different numbers of topics, such as 5, 7, 10, 15, 20 and 35, by varying the number of target models (num_topics) and the number of words per topic (num_words) parameters of the model. Coherence scores were computed each time. Coherence scores for each run were assessed. It was found that the coherence score was consistently high when the number of topics was seven with different parameter values.

Figure 2, Figure 3, Figure 4 present outputs from the LDA model for various hyperparameters.

The final output of topics and keywords that emerged from the tuned model was reviewed. The keywords and their contribution to each topic were analysed. The articles that correspond to these topics were reviewed, and each topic was labelled with an appropriate topic title.

Figure 2. Coherence Value for Topics Generated with Number of Topics = 35 and Number of Words = 15 per Topic.

Figure 3. Coherence Value for Topics Generated with Number of Topics = 25 and Number of Words = 15 per Topic.

Figure 4. Coherence Value for Topics Generated with Number of Topics = 20 and Number of Words =15 per Topic.

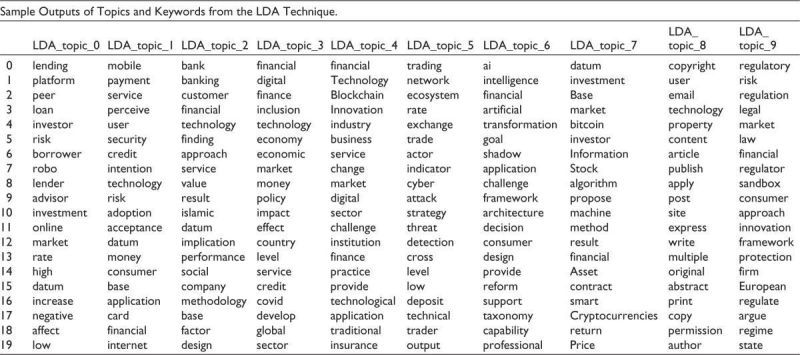

Table 1 presents the list of topics and corresponding keywords that emerged as output from the final LDA model.

Table 1. Output of the LDA Model with Topics and Word Scores.

Results

The study identified seven dominant clusters out of the 1,321 documents identified through topic modelling. These clusters highlight topics such as algorithmic trading, blockchain, crowdfunding, sustainable finance and regulatory technologies. The findings suggest that these clusters are not isolated and unique but are overlapping indicating few studies fall at the intersection of these clusters. Figure 5 shows the distribution of articles in each cluster. In such cases, a combination of the top 10 keywords, the weightage of the keywords along with manual review of the corresponding articles was used to find and assign suitable topics. The output of the topic model provides the keywords and a pointer to the corresponding article from which the topic was extracted.

Figure 5. Emerging Distribution of the Articles by Key Topics.

Topic Cluster 1. Algotech

Articles in the first cluster pertain to the field of algorithmic trading. Algorithmic trading is a new concept which uses ML to make predictions based on historical data using advanced technologies such as deep learning models (long short-term memory networks). The Design Science Research model is used to create a high-frequency trading strategy minute by minute for a stock, proving the existence of economic benefit using the strategy against out-of-sample trading (Vo & Yost-Bremm, 2020). Algorithmic trading offers sophisticated decision-making tools, maximising profits by taking advantage of optimal position, price, trading time and volume (Fahlenbrach & Frattaroli, 2021). It offers the adoption and diffusion of technology in financial services at an accelerating pace (Tao et al., 2021).

Deep learning models capture nonlinear patterns of stock data which statistical or traditional models are unable to capture (Horobet et al., 2024). This means deep learning models are able to capture the complexity of the data. This trade can generate profits at a frequency that is impossible for a human trader to do manually. The platform runs on sophisticated mathematical models which negate the effect of human emotions on trading.

Topic Cluster 2. Blockchain

Blockchain can be visualised as a shared ledger of records which is digitally maintained, but to ensure its security timestamps/hashtags are used (Chen & Chen, 2020), any change in the records needs a proof of work, which means it can only be done with substantial effort (Agarwal & Chua, 2020). Cryptographic proof is the substitute for trust, and blockchain can be copied/duplicated and shared with relevant recipients (Choi & Lee, 2020). The transactions are irreversible, and the biggest advantage of blockchain is that it cannot be tampered with or altered (Park & Park, 2020). Blockchain is gaining popularity and is being used in areas like the maintenance of P2P transactions, trading, capital markets SCM, international payments, bank ledgers and most importantly the cryptocurrency such as Bitcoin.

Topic Cluster 3. Crowd Funding

The benefits of technology can be leveraged to create funding opportunities for small businesses/retailers wherein borrowers and lenders come together on a digital platform and mobilisation of funds can happen (Athique, 2019). Hence the symbolic name ‘crowdfunding’. Crowdfunding uses small amounts of funds from a large number of individuals to cater to the financial needs of a new business venture to meet medical and natural emergencies. Enormous opportunities have been created through the crowdsourcing platform (Lin & Pursiainen, 2021) for entrepreneurs due to the speed and ease of collecting money, but since the regulatory norms vary from country to country (Cheng & Qu, 2020, Lin & Pursiainen, 2021), not all nations permit using this platform for ‘profit-making’ businesses (Luo, 2016). For example, in India, crowdfunding is permitted for donations, for example, Ketto, but not for funding commercial businesses. Other platforms for business ventures in other parts of the world include KickStarter and Indiegogo (Lin & Pursiainen, 2021).

Topic Cluster 4. Digital Banking

E-commerce exclusively relies on financial institutions as trusted third parties to process electronic payments (Nakamoto, 2008). This has resulted in the increasing popularity of digital banking, which includes all banking activities done using a technology platform (Nuyens, 2019). Digital banking also encompasses the use of a mobile phone for receiving money or making payments through a mobile wallet (Mhlanga, 2020). So great is the ease of use and the speed of transactions 24 × 7 that digital banking is fast replacing traditional banking and has already replaced most consumer and capital banking processes (Ang & Kumar, 2014; Polasik & Piotrowski, 2016).

Topic Cluster 5. Fintech Adoption

Fintech adoption is the backbone of launching products in the fintech domain (Brener, 2019; Karjaluoto, 2017). It refers to the adoption of digital technology platforms for directing financial transactions such as money transfers, insurance, trading in shares or cryptocurrency and borrowing and lending money (Hoang et al., 2021). Fintech adoption has been rising progressively over the years, with 75% of consumers globally adopting some form of money transfer in 2019 itself (Shao, 2021, statista.com). Between 2021 and 2022, the US consumers fintech adoption rose from 58% to 88%, a gigantic 52% growth. As nations, China and India have reported gigantic growth in fintech adoption over the years.

Topic Cluster 6. RegTech

RegTech refers to regulatory technologies which are prevalent in the fintech ecosystem. These are important as they are needed to control, enhance and track regulatory compliances. As fintech adoption increases across the globe and more and more consumers start transacting on these platforms, there is a need to have robust controls to prevent customer- and business-related frauds (Yuan & Xu, 2020), instil trust in the processes and have defined legal protocols for the aggrieved and punishing the guilty ( Chen et al., 2017). RegTech is more in controlled organisations such as the financial sector, healthcare and gaming, which impact people directly (Schulte, 2015). Along with streamlining compliances, RegTech also saves time and helps in managing repetitive work (Brown & Piroska, 2021). Unfortunately, the fast-paced fintech adoption has given little time to the regulatory bodies to set up a well-defined regulatory framework; thus, more research is being done in this area to identify the gaps (Omarova, 2021).

Topic Cluster 7. Sustainable Finance

As sustainability got attention in the SDGs of the United Nations in the form of clean energy and sustainable cities, the corporate focus has also shifted to the triple bottom line and sustainable finance (SF). SF takes into consideration environmental, social and governance requirements to make investment decisions in the financial sector, which leads to an increase in long-term investments into areas such as projects and sustainable economic activities (Knight & Wojcik, 2020; www.wordlbank.com). The activities covered include investing in green technologies, in organisations that demonstrate social inclusion, good governance across areas such as manufacturing, healthcare, energy, technology, capital goods and transportation (De la Poza, 2022; Ding et al., 2018). SF would include all those practices, standards, regulations and norms which generate returns for the business taking care of the environment along with economic and social objectives (Harris, 2021). SF aims to create an inclusive society and emphasises the long-term impact of economic investments (Khan et al., 2021).

Conclusion

Fintechs’ technological advantage over traditional financial institutions is their key driver of success and competitive advantage. Undoubtedly, fintech has had a value add for the customer as it connects people or services through platforms and has enhanced efficiency for the business.

Fintech activities as per BIS 2020 include equity crowdfunding (capital raising), digital banking, fintech balance sheet lending, loan crowdfunding (deposit and lending), robo-advice (asset management), e-money, digital payment services, insurtech business models and financial activities related to crypto-assets. Enabling technologies include application programming interface (API) cloud, biometric, distributed ledger technology (DLT), AI and ML. Policy enablers include digital ID, open banking, data protection, innovation facilitators and cyber security. Based on the literature review, the verticals of fintech are (a) digital lending and capital raising, (b) payments excluding digital currencies (c) Wealthtech (including trading), (d) Insurtech, (e) blockchain technology and cryptocurrency, (f) Proptech and (g) RegTech and Suptech.

The fintech sector evolved after the sub-prime lending crisis emanating from the growing insecurity in the minds of people, as there was a dire necessity to have financial services which provided quick and reliable accessibility 24 × 7. For any technology to be usable, it should be easy, fast, scalable and understandable, which is applicable to fintech.

The findings of this study have significant implications for various stakeholders mentioned as follows.

For policymakers, the insights can guide the development of regulations that foster innovation while ensuring consumer protection and financial stability. Traditional banks and financial entities can leverage fintech advancements to enhance their service offerings and operational efficiency. Understanding the evolving landscape of fintech can help regulators create frameworks that balance innovation with risk management. The study provides valuable information on emerging trends and technologies that start-ups can capitalise on to gain a competitive edge over fintech start-ups.

Based on the findings, a conceptual framework can also be developed to illustrate the interplay between fintech activities, enabling technologies and policy enablers. The framework can serve as a foundation for future research and practical applications, highlighting the various ways through which fintech innovations impact various sectors and stakeholders. The framework can also identify and suggest standard regulatory requirements for fintechs to follow, thereby ensuring adherence to regulatory requirements and compliance.

The first limitation of the study is that the corpus used for text analysis consists of only academic papers. This gives a clear understanding of the research being pursued by the scholars in the field but gives less understanding of how the industry is changing with respect to contemporary practices in the area of fintech. Second, only key themes have been focussed upon in the study. A detailed analysis of the text could disclose peripheral topics which have not been analysed. Despite these limitations, this study is an important step towards understanding the research in the area of fintech and emerging trends.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

ORCID iDs

Yamuna TN https://orcid.org/0009-0003-3679-7066

Kirti Dutta https://orcid.org/0000-0001-5021-3440

Ramakrishna Dantu https://orcid.org/0000-0002-8671-8034

Appendix A

Agarwal, S., & Chua, Y. H. (2020). Fintech and household finance: A review of the empirical literature. China Finance Review International, 10(4), 361–376.

Ang, J. B., & Kumar, S. (2014). Financial development and barriers to the cross-border diffusion of financial innovation. Journal of Banking & Finance, 39, 43–56.

Anshari, M., Almunawar, M. N., & Masri, M. (2020). Financial technology and disruptive innovation in business: Concept and application. International Journal of Asian Business and Information Management (IJABIM), 11(4), 29–43.

Athique, A. (2019). A great leap of faith: The cashless agenda in digital India. New Media & Society, 21(8), 1697–1713.

Bollaert, H., Lopez-de-Silanes, F., & Schwienbacher, A. (2021). Fintech and access to finance. Journal of Corporate Finance, 68, 101941.

Brener, A. (2019). Payment service directive II and its implications. In T. Lynn, J. G. Mooney, P. Rosati, & M. Cummins (Eds.), Disrupting finance (pp. 103–119). Palgrave.

Brown, E., & Piroska, D. (2021). Governing fintech and fintech as governance: The regulatory sandbox, riskwashing, and disruptive social classification. New Political Economy, 27(1), 1–14.

Buckley, R. P., Arner, D. W., Zetzsche, D. A., & Selga, E. (2019). The dark side of digital financial transformation: The new risks of fintech and the rise of techrisk. UNSW Law Research Paper No. 19–89.

Butt, S., & Khan, Z. A. (2019). Fintech in Pakistan: A qualitative study of bank’s strategic planning for an investment in fintech company and its challenges. Independent Journal of Management & Production, 10(6), 2092–2101.

Chen, R. R., & Chen, K. (2020). A 2020 perspective on ‘Information asymmetry in initial coin offerings (ICOs): Investigating the effects of multiple channel signals’. Electronic Commerce Research and Applications, 40(4), 100936.

Chen, Z., Li, Y., Wu, Y., & Luo, J. (2017). The transition from traditional banking to mobile internet finance: An organizational innovation perspective: A comparative study of Citibank and ICBC. Financial Innovation, 3(1), 1–16.

Cheng, M., & Qu, Y. (2020). Does bank fintech reduce credit risk? Evidence from China. Pacific-Basin Finance Journal, 63, 101398.

Choi, H., & Lee, K. (2020). Micro-operating mechanism approach for regulatory sandbox policy focused on fintech. Sustainability, 12(19), 1–11.

Coetzee, J. (2018). Strategic implications of fintech on South African retail banks. South African Journal of Economic and Management Sciences, 21(1), 1–11.

Cogitotech. (2021, September 27). Topic modeling: Algorithms, techniques, and application. https://www.datasciencecentral.com/topic-modeling-algorithms-techniques-and-application/

Dandala, B., Joopudi, V., & Devarakonda, M. (2019). Adverse drug events detection in clinical notes by jointly modeling entities and relations using neural networks. Drug Safety, 42(1), 135–146.

Das, S. R. (2019). The future of fintech. Financial Management, 48(4), 981–1007.

Ding, D., Chong, G., Chuen, D. L. K., & Cheng, T. L. (2018). From ant financial to Alibaba’s rural Taobao strategy: How fintech is transforming social inclusion?

Drasch, B. J., Schweizer, A., & Urbach, N. (2018). Integrating the ‘troublemakers’: A taxonomy for cooperation between banks and fintechs. Journal of Economics and Business, 100, 26–42.

Fahlenbrach, R., & Frattaroli, M. (2021). ICO investors. Financial Markets and Portfolio Management, 35, 1–59.

Financial Stability Board. (2017). Financial stability implications from fintech. https://www.fsb.org/2017/06/financial-stability-implications-from-fintech/

Harris, J. L. (2021). Bridging the gap between ‘fin’ and ‘tech’: The role of accelerator networks in emerging fintech entrepreneurial ecosystems? Geoforum, 122, 174–182.

Hasan, R., Ashfaq, M., & Shao, L. (2021). Evaluating drivers of fintech adoption in the Netherlands? Global Business Review, 25(6), 1576–1589.

Hendrikse, R., Van Meeteren, M., & Bassens, D. (2020). Strategic coupling between finance, technology and the state: Cultivating a fintech ecosystem for incumbent finance. Environment and Planning A: Economy and Space, 52(8), 1516–1538.

Hoang, Y. H., Nguyen, D. T. T., Tran, L. H. T., Nguyen, N. T. H., & Vu, N. B. (2021). Customers’ adoption of financial services offered by banks and fintechs partnerships: Evidence of a transitional economy. Data Science in Finance and Economics, 1(1), 77–95.

Holmes, C., & King, R. (2019). The evolution of business-to-business fintech: What the future holds. Journal of Payments Strategy & Systems, 13(3), 217–225.

Hommel, K., & Bican, P. M. (2020). Digital entrepreneurship in finance: Fintechs and funding decision criteria. Sustainability, 12(19), 8035.

Horobet, A., Boubaker, S., Belascu, L., Negreanu, C. C., & Dinca, Z. (2024). Technology-driven advancements: Mapping the landscape of algorithmic trading literature. Technological Forecasting and Social Change, 209, 123746.

Jagtiani, J., & Lemieux, C. (2018). Do fintech lenders penetrate areas that are underserved by traditional banks? Journal of Economics and Business, 100, 43–54.

Khan, A., Ahmad, A., & Shireen, S. (2021). Ownership and performance of microfinance institutions: Empirical evidences from India. Cogent Economics & Finance, 9(1). https://doi.org/10.1080/23322039.2021.1930653

Knight, E., & Wojcik, D. (2020). Fintech, economy and space: Introduction to the special issue. Environment and Planning A, 52(8), 1490–1497.

Lee, J. M., & Kim, H. J. (2020). Determinants of adoption and continuance intentions toward internet-only banks. International Journal of Bank Marketing, 1, 40–52.

Lin, T.-C., & Pursiainen, V. (2021). The round number heuristic and entrepreneur crowdfunding performance. Journal of Corporate Finance, 68(2), 101894.

Mhlanga, D. (2020). Industry 4.0 in finance: The impact of artificial intelligence (AI) on digital financial inclusion. International Journal of Financial Studies, 8(3), 1–14.

Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic cash system. www.bitcoin.org

Nuyens, H. (2019). How disruptive are fintech and digital for banks and regulators? Journal of Risk Management in Financial Institutions, 12(3), 217–222.

Omarova, S. T. (2021). Fintech and the limits of financial regulation: A systemic perspective. In Routledge handbook of financial technology and law (p. 18). Routledge.

Park, S., & Park, H. W. (2020). Diffusion of cryptocurrencies: Web traffic and social network attributes as indicators of cryptocurrency performance. Quality & Quantity: International Journal of Methodology, 54(1), 297–314.

Pennacchiotti, M., & Gurumurthy, S. (2011). Investigating topic models for social media user recommendation [Paper presentation]. The 20th international conference companion on world wide web, Hyderabad, India, 28 March–1 April 2011.

Polasik, M., & Piotrowski, D. (2016). Payment innovations in Poland: A new approach of the banking sector to introducing payment solutions. Ekonomia i Prawo, Uniwersytet Mikolaja Kopernika, 15(1), 103–131.

Rafay, A. (Ed.). (2019). Fintech as a disruptive technology for financial institutions. IGI Global.

Sabeeh, V., Zohdy, M., & Bashaireh, R. A. (2021). Fake news detection through topic modeling and optimized deep learning with multi-domain knowledge sources. In Advances in data science and information engineering (pp. 895–907). Springer.

Schulte, P. (2015). The next revolution in our credit-driven economy: The advent of financial technology. Wiley.

Sibanda, W., Ndiweni, E., Boulkeroua, M., Echchabi, A., & Ndlovu, T. (2020). Digital technology disruption on bank business models. International Journal of Business Performance Management, 21(1–2), 184–213.

Stulz, R. M. (2022). Fintech, bigtech, and the future of banks. Journal of Applied Corporate Finance, 34(1), 106–117.

Takeda, A., & Ito, Y. (2021). A review of fintech research. International Journal of Technology Management, 86(1), 67–88.

Tao, R., Su, C. W., Xiao, Y., Dai, K., & Khalid, F. (2021). Robo advisors, algorithmic trading and investment management: Wonders of fourth industrial revolution in financial markets. Technological Forecasting and Social Change, 163, 120421.

Tatuev, A., Kutsuri, G., Keferov, M., Milenkov, A., & Ovcharova, N. (2020). Technological challenges to the bases of banking in the context of innovation management. Amazonia Investiga, 9(25), 256–265.

Tepper, N., Hashavit, A., Barnea, M., Ronen, I., & Leiba, L. (2018). Collabot: Personalized group chat summarization [Paper presentation]. The 11th ACM international conference on web search and data mining (WSDM ‘18) (pp. 771–774). Association for Computing Machinery. https://doi.org/10.1145/3159652.3160588

Thakor, A. V. (2020). Fintech and banking: What do we know? Journal of Financial Intermediation, 41, 100833.

Vives, X. (2019). Digital disruption in banking. Annual Review of Financial Economics, 11, 243–272.

Vo, A., & Yost-Bremm, C. (2020). A high-frequency algorithmic trading strategy for cryptocurrency. Journal of Computer Information Systems, 60(6), 555–568.

Vucinic, M. (2020). Fintech and financial stability potential influence of fintech on financial stability, risks and benefits. Journal of Central Banking Theory and Practice, 9(2), 43–66.

Wang, D., Zhu, S., Li, T., & Gong, Y. (2009). Multi-document summarization using sentence-based topic models [Paper presentation]. The ACL-IJCNLP 2009 conference short papers (pp. 297–300). Association for Computational Linguistics.

Yuan, K., & Xu, D. (2020). Legal governance on fintech risks: Effects and lessons from China. Asian Journal of Law and Society, 7(2), 1–30.