1 Goizueta Business School, Emory University, Atlanta, GA, USA

2 Rutgers Business School Newark and New Brunswick, Rutgers University, Newark, NJ, USA

3 F.W. Olin Graduate School of Business, Babson College, MA, USA

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

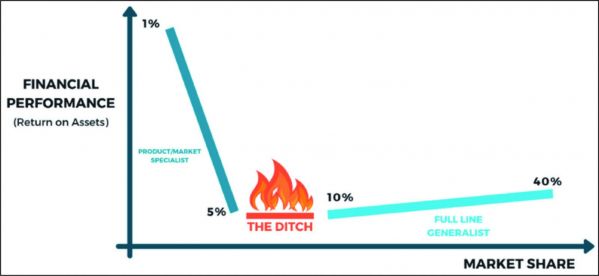

In this article, the authors provide an overview of the Global Rule of Three. Competitive markets grow, consolidate, and mature, ultimately leading to the emergence of three full-line generalists. The financial performance of full-line generalists gradually improves with greater market share, while the performance of specialists drops off rapidly as their market share increases. Businesses that lack the scale and scope advantages of generalists, and the focus and service advantages of specialists get stuck in between—in the ditch range. The Rule of Three structure generates optimal operational efficiency in competitive markets and positive impact on all stakeholders. It represents an empirical reality that must be factored into the strategy of businesses of all sizes. Competitive markets evolve in a predictable fashion across industries, and they go through similar lifecycles. Many generalists that are dominant in their countries or regions are unable to exert the same leadership when the market globalizes. Each century has been marked by the successes of different regions and cultures. The old triad power which consisted of Western Europe, North America, and Japan is being replaced by America, China, and India. The new triad power comes with possible problems, especially between China and the US. Their differences will inevitably create tensions, and India will increasingly become a more strategic partner to both. Increasing demand for the world’s limited resources will necessitate resource-driven global expansion for enterprises and nations, further transforming the way business is conducted in the 21st century.

globalization, global marketing, corporate strategy, marketing strategy, triad power, generalists, specialists, financial performance

Introduction

Although the phenomenon of increasing market concentration is not new, the COVID-19 pandemic has significantly accelerated the consolidation of power and wealth globally. According to International Monetary Fund, in 2025, more than half of global growth is expected to come from just three countries (27.7% from China, 13% from India, and 10.4% from the United States), whereas the traditional powerhouses such as Germany, United Kingdom, and France are expected to contribute less than 5% (Tanzi & Lu, 2020).1

An examination of economic growth over the 19th century suggests that the industrial revolution and the colonial expansion, which fueled its factories, made it the European century. By most metrics, the 20th century can be claimed by the United States, and the 21st century (or at least the first half of it) will be remembered as the Asian century. There was a time when 45% of world trade and 70% of the world’s GDP were concentrated among the old triad. Merely 15 countries conducted and controlled much of world trade then, and it was as if the rest of the world did not matter. The status quo prevailed throughout the Cold War until communism collapsed in 1991. That paradigm has long shifted.

The old triad power of the United States, European Union, and Japan is quickly giving way to a new one among the United States, China, and India. The influence of Europe’s perennial powers has waned, and even the United States is projected to fall behind as the growth engine of the world. This shift from West to East is poised to create disruption at all levels—from micro to macro. Who would have guessed that Chindia would overtake the United States so soon (Sheth, 2011) Yet we maintain that this progression has been all very predictable.

This article covers two distinct yet intertwined topics based on our book, The Global Rule of Three: Competing with Conscious Strategy (Sheth et al., 2020). In the first half, we introduce the Global Rule of Three and discuss the globalization of competition. In the second half, we discuss the macro-phenomenon of the rise of the new triad power. The impact of both on our future will be unique and powerful.

The Rule of Three

The Rule of Three theory (Sheth & Sisodia, 2002) posits that competitive markets tend to converge toward a structure dominated by three large players (i.e., generalists), whereas much smaller specialists occupy the peripheries. The three-player-dominated market structure outperforms competing structures in terms of financial performance. Generalists are volume-driven, and specialists are margin-driven. In between them, there are “ditch” players that lack the volume (and economies of scale and scope) of the generalists and the focus and service levels of the specialists. The businesses that are stuck in the middle underperform both generalists and specialists consistently.

The premises of the Rule of Three have been tested and supported empirically using data from thousands of firms in hundreds of markets (e.g., Reeves et al., 2012; Uslay et al., 2010, 2017). Even as the boundaries between markets blur, the empirical results from four decades of data have been highly robust.2 The findings were consistent even after controlling for extant explanations such as firm size, firm age, market-to-book ratio, market concentration, and market share. Markets with three dominant players outperformed those with more than three players by 116% and those with fewer than three players by 209%, on average, in terms of ROAs (Uslay, 2015a; Uslay et al., 2010). Similarly, generalists outperformed those stuck in the ditch by 68%, and specialists did so by an even more impressive 116% (Uslay, 2015b). Game theoretical experiments have also supported the same conclusion: “two are few and four are many” (Huck et al., 2004, p. 435). The Rule of Three is illustrated in Figure 1.

The Rule of Three (Sheth & Sisodia, 2002; Sheth et al., 2020) represents a law-like empirical reality that lends itself to numerous generalizations, including the following:

Figure 1. The Rule of Three

Source: Adapted from “Competitive Positioning: The Rule of Three” presentation by Jagdish N. Sheth, 2017).

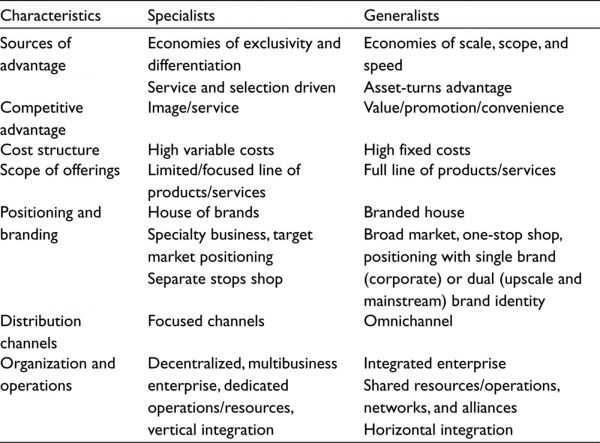

In Table 1, we provide an overview of the characteristic differences between generalists and specialists.

Table 1. Characteristics of Generalists and Specialists

Source: The authors.

Why Three

The Rule of Three is rooted in both industrial organization economics and consumer psychology. Game theoretical experiments have demonstrated that markets with three major players display more stability and commensurate competition than those with fewer players. Markets with a single dominant player typically lack innovation. Duopoly markets can have collusion on one extreme and mutually destructive price wars on the other extreme. In markets with three large players, the possibility of a coalition among two players diminishes potentially predatory campaigns by an aggressor and leads to mutual forbearance. A market with more than three players leads to excessive competition that drives down the average profitability, and the fourth and further players become casualties in the drive toward consolidation and efficiency.

Finally, most consumers seriously consider three options for their purchases (Howard & Sheth, 1969), and the same phenomena may apply to B2B markets as well (Malhotra & Uslay, 2018). More than three front-runners are often unnecessary and can even decrease consumption (Fenstermaker, 2013), whereas fewer than three options are usually insufficient. Hence, the Rule of Three prevails. It provides for not only an optimal level of choice for consumers but also enables above-average returns for investors, gainful employment, and the ability to invest in R&D and long-term performance and innovation. In that regard, we consider Rule of Three to be stakeholder oriented, even though the metrics used to measure performance in empirical studies to date have primarily been financial.

Exceptions to the Rule of Three

Although the Rule of Three is commonly observed across various industries, over time and across continents, there are several factors that impede the convergence to three key players:

Regulation: When regulations hinder actions as consolidation (as experienced in the US and Japan’s banking sectors), or allow the existence of natural monopolies (as in the US local telecommunication sector), the Rule of Three is rendered ineffective or not operational. However, when such industries get deregulated, the rule goes into effect, as the cases of US trucking, airlines, and telecommunications demonstrate.

Exclusive rights: When rights such as patents and trademarks play significant roles in the market, players can be considered as submonopolies, free from market forces, and the Rule of Three is not likely to govern market evolution. However, in the recent past, there have been significant changes even in industries with high levels of patent protection such as the pharmaceutical industry, with gradual advancements toward the Rule of Three. This has been instigated by actions such as mergers and the pharmaceutical firms’ involvement in the growing generic sectors and over-the-counter drugs. Patent-based submonopolies are being eroded as more large firms target major therapeutic classes with various drug formulations, and the Rule of Three appears to prevail in this sector as well.

Licensed economy: Although the Rule of Three did not initially apply to the economies of the old communist blocs of India, China, and Brazil, following deregulation in these markets, it has become highly applicable. The World Trade Organization (WTO) has also played a significant role in enhancing the competitive landscape across industries.

Significant barriers to trade and foreign ownership of assets: When there are substantial trade barriers, the Rule of Three is much more likely to apply at the national level rather than globally. However, it can still be expected to apply via the formation of multinational groups and alliances, as is already the case with airline alliances, and is likely to occur for global telecommunications.

Markets with a high degree of vertical integration: When buyers are limited to in-house suppliers, we tend not to see three full-line players in the supplier market. With vertical integration, competitiveness in the market forces operations is curtailed. The consumers and the suppliers are internally tied up, restricting selling and purchasing in the free market.

Markets with combined management and ownership: Market processes are not allowed to work in such instances where the ownership and control are combined, as in the case of professional services. Ownership is attributed to emotional attachments that can inhibit rational economic decision-making and diminish opportunities for mergers and demergers.

Notably, most of these exceptions have been diminishing as more industries are becoming more market oriented through privatization, deregulation, and the WTO influence. For example, many professional services firms have abandoned the partnership model and become publicly traded.

The Global Rule of Three

The rationale for the Global Rule of Three is simple and is grounded in the following corollary: No matter the scope of the market, the Rule of Three prevails. As the scope of a market expands from local to regional, regional to national, or national to global, the processes that drive the Rule of Three, namely consolidation and standardization, still apply. Regional or national market leaders often find themselves trailing as the market globalizes (e.g., Bosch). Historically, global leaders typically (but not always) emerged from the triad of North America, Western Europe, and the Asia-Pacific region (see Ohmae [1985] and Sheth and Sisodia [2006] for treatises regarding the triad power). Typically, the leaders in each of these three markets emerge as global generalists. For example, in the tire industry, the global leaders are Bridgestone from Japan, Michelin from France, and Goodyear from the United States. However, to survive and thrive, a global leader must have a strong market presence in at least two of these three markets. Other players typically get acquired or gradually become product or geographic market specialists (Cooper Tires of United States, now owned by Apollo of India, is an example for both). Furthermore, if a country specializes in an industry, it may be home to two or even all three global leaders. Current examples of such consolidation can be found in the steel industry (e.g., historically the United States and now China). Fundamental axioms of the Global Rule of Three can be summarized as follows:

Global Generalists

Global Specialists

The New Triad Power

Markets are governed by two major factors: (a) competition which was the focus of the first half of our article and (b) policy which will be our focus for the rest of it. Next, we discuss the macro factors that are driving the new global triad.

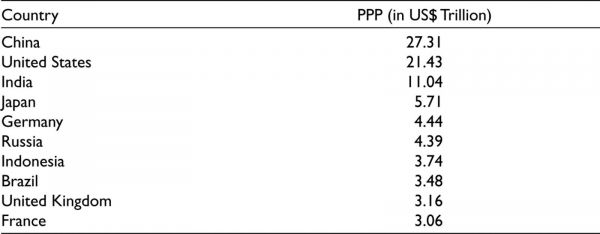

A review of GDP based on purchasing power parity (which is a more appropriate metric than using nominal exchange rates) quickly reveals the origins of the new triad power. Half of the top 10 and two of the top 3 spots are assumed by developing markets. Akin to how the United States replaced the traditional European powerhouses of Germany, France, and the United Kingdom in the last century, China and India have already replaced the EU and Japan in the new triad of the 21st century (see Table 2).

Table 2. Country GDP Indexed to Purchasing Power Parity (2019)

Source: Knoema (2020).

With the rise of the new triad power between China, India, and the United States, global leaderboards across all sectors are being challenged and reorganized, and the global leaders are increasingly more likely to hail from emerging markets. While the 20th century relied extensively on advanced nations, the growth in the 21st century will come primarily from emerging markets. We posit that deregulation, low barriers to trade, and free markets drive the convergence toward the Global Rule of Three. Protectionist policies may temporarily impede but not halt this eventual progression.

Drivers of the New Triad

Rise of global enterprises from Chindia: The rise of large multinational firms from the emerging markets of China and India is inevitable (Sheth, 2011). Huawei was not a household name a decade earlier; yet it leads the global telecom infrastructure market today, and its rapid dominance has even made the US government take retaliatory action. Tata is another global brand name with large stakes across numerous industries. Tata Consultancy Services is #3 globally after Accenture and IBM, and Tata Tea is #2 globally following Unilever’s Lipton (The Economic Times, 2019). Hindalco has become a major Indian player in the global aluminum market. Similarly, Chinese banks, appliances, and e-commerce firms are rising to global dominance. For example, Haier has become the world leader in appliances, and Alibaba prevails over Amazon based on operating margin and earnings (Mourdoukoutas, 2018).

Shift of R&D to Chindia: Corporate R&D centers of various industries ranging from pharmaceuticals to information technology and telecom will increasingly move to Chindia to be closer to talent. For example, Intel’s high-end Xeon 7400 chip was developed by its Bangalore R&D center (Yamado, 2015). There are well over 400 foreign-invested R&D centers in Shanghai (The American Chamber of Commerce in Shanghai, 2018).

The focus of innovation becomes affordability: If necessity is the mother of invention, affordability can be considered the father of innovation. Frugal innovations, that is, acceptable quality at affordable prices for the masses, will increasingly be a primary imperative for innovation (Bhatti et al., 2018).

The fusion of cultures: Rudyard Kipling’s sentiment that “East is East and West is West, and never the twain shall meet” no longer rings true. Yes, Asians are westernized (wearing jeans); however, the Western world is also simultaneously easternized through music, entertainment, arts, culture, spirituality, and food (e.g., Buddhism, feng shui, Indian curry, K-pop). Whereas westernization was export oriented, easternization is more about blending, for example, Christian yoga! Since western cultures are more open to innovation and external influence, the easternization phenomenon will take place faster than westernization did, and we will end up with a fusion.

Private equity in emerging markets: Multinational corporations are already active players in Chindia. Coca-Cola believes that most of its growth over the next few decades will come from China (like it came from India in the past few decades). Similarly, McDonald’s, KFC, Caterpillar, General Motors, Starbucks all have large-scale operations which are still growing. From fast food, automobiles and education to health care, global leaders have paved their way to Asia (an exception being the defense industry due to heavy regulation). KKR, Blackstone, and other major private equity players will be next. Financial markets follow growth, as well. Shanghai will become the world’s largest capital market, surpassing both New York and London exchanges (if one combines public, private equity, and debt markets).

Impact of the New Triad on Global Resources

Resource-driven global expansion: Just like farmers look for fertile land, IBM has decided it needs to have a major presence in India to be close to human resources. It might as well be considered an Indian company, since more than a third of its employees reside in India, which surpasses the number of those in the United States (Goel, 2017). Similarly, Accenture, which could become the largest IT employer in India, has more than a third of its workforce, some 150,000 employees reside in India, which is three times its headcount in the United States (Phadnis, 2018).

Notably, these expansions were driven primarily by resources rather than market considerations.

Resource-driven global M&A: Since the opportunities for organic investment and growth are limited, many global mergers will be driven by the need to expand to where the resources are. The big wave of M&A in the mining sector spanning firms from Australia, Canada, Latin America, Africa, and even the Caribbean can be considered as an example of this. Four of the five mega deals (exceeding $10B in value) were cross-border. Brazilian Companhia Vale do Rio Doce acquired Canadian Inco for $13B in 2006 to become the #2 nickel miner globally. Similarly, Anglo-Austrian Rio Tinto acquired Canadian Alcan for $38B in 2007 to become the largest producer of aluminum and bauxite. More recently, Barrick Gold of Canada spent $18B to acquire Randgold of Mali in 2018 to create the largest gold producer globally (Husseini, 2018).

The emergence of strange bedfellows: Wary of their future “food security,” Gulf nations have long been involved with land purchases in Ethiopia, Kenya, Mali, Mozambique, Senegal, Sudan, and Tanzania. African land areas larger than the United Kingdom have been sold to or have been rented by foreign investors (Pomroy, 2014). China’s Belt and Road Initiative (BRI) will also be critical for its access to global resources. The BRI infrastructure investments involve a staggering number of 65 countries from Asia, Europe, Africa, the Middle East, and the Americas. These 65 countries collectively account for 30% of GDP, 62% of the population, and 75% of known energy reserves globally (World Bank, 2018). However, not all is well with BRI. The mega project (estimated to cost $8 trillion) is also generating large sums of debt for numerous countries such as Pakistan, Djibouti, the Maldives, Laos, Mongolia, Montenegro, Tajikistan, and Kyrgyzstan. It is instructive to remember that the United States bought Louisiana from France for $15M in 1803, roughly $300M today, and Alaska from Russia for $7.2M in 1867, approximately $140M today, when they faced financial hardships (Global Policy Forum, 2006; Ming, 2018). Given the natural resources of the countries along the belt and road, it is conceivable that BRI may serve an agenda of territorial expansion.

With the political unacceptability of direct land concession to foreign nations, concessions and debt servitudes can come in such forms as sales, long-term leases, and other schemes, enabling resource access to Chinese corporations or the military. Examples already abound. The debt burden caused Sri Lanka to transfer control of the Hambantota port to state-owned China Harbor, including 15,000 acres surrounding pieces of land for 99 years (Chandran, 2017). The deal cleared one billion dollars off the debt. However, the country is still in massive debt to China, which come with significant interest rates (Abi-Habib, 2018). Another country massively indebted to China is Djibouti, with equivalent of 88% of its GDP being Chinese loans. China built its first overseas military base in Djibouti soils (Cheng, 2018). With such implications, Bangladesh and Malaysia have revised or canceled their previous commitments in order to curtail their national debt strains (Chandran, 2019). China is also focused on investing in Africa’s infrastructure and exerts significant soft power in the continent.

Rise of scarcity-driven profits: Significant profits are achievable at the commodity level, resulting from the unanticipated shortage of raw materials. This was evident in the case of African swine fever, which resulted in a 36% increase in pork prices in China during the first week of April 2019 and expected to increase China’s pork imports by 33% in 2019 up to 2 million metric tons (Liu & Wang, 2019). This was also experienced during the COVID-19 pandemic, with prices of eggs in the United States increasing by 16% in 2020 also affected other items such as groceries, meat, and fruits (Cortes, 2020). Interestingly, industries involved in raw material and commodities can be subject to higher margins than final products in the near future.

Shortage-driven breakthrough innovations: The focus will increasingly be on the substitution of natural resources rather than manual labor automation (e.g., robotics). Various animals, such as camels and horses, among others, have already been cloned. Artificial pearls can be produced faster and more economically than natural pearls. While physics and chemistry were crucial for success in the 20th century, biomedical sciences, machine learning, and nanotechnologies are quickly becoming key in the current one.

Sustainability imperative: There are 3090 active landfills and over 10,000 old municipal landfills in the United States. Yet 90% of waste is not recycled. Twenty-five million trees in the United States would be saved annually if only 10% of newspapers were recycled (Brucker, 2018). The most severe restrictions to the spectacular growth of Chindia will emerge out of the environment rather than lack of capital or technology. Climate change will increasingly be top of mind. Over a quarter of US metropolitan cities are predicted to experience over 100 days with over 95__degreesign F annually by year 2060 compared to the current 1% (Blackrock Investment Institute, 2019). Also, China will experience even worse environmental conditions due to heatwaves caused by climate change (McKenna, 2019). The critical point is that businesses should change their focus from exploiting nature to nurturing it (Suhas & Sheth, 2016).

Impact of the New Triad on Geopolitics

Economics as a driver of politics: Economics significantly influences politics. The general population’s economic sustainability enables the politicians’ survival regardless of the ruling philosophy; the citizens’ economic well-being becomes the driving factor. This transcends political regimes, and having realized this, the BRICS countries (Brazil, Russia, India, China, and South Africa) are hosting their own summits. South–South trade and investment agreements are increasingly replacing the North–South trade.

G-8 becomes G-20: G-7 was created based on the need to deal with the energy crisis, and later Russia joined it too. However, over time, a larger league of 20 nations was invited to the table. The G-20 accounts for roughly two-thirds of the world’s population, with 85% of the global economic output contributing to 75% of international trade and 80% of global investments (Kuo, 2018). With the United States, China, and India at the helm, the G-20 will further increase its influence at the expense of traditional European powers.

Rise of multilateral politics: With the new triad, multilateralism has replaced the American universal view. America, Asia, and Europe each have a unique perception of how the world should be governed, and the US dominance during the post-Soviet era is over. China is extending its influence, evidenced by the Philippines following China’s lead regarding disputes in the South China Sea at the expense of its historical ally, the United States. China is bound to clash with countries such as Taiwan and Vietnam over border disputes (Gertz, 2019). As the US influence diminishes, the resulting political arena will be complex yet surprisingly stable since the triad will offer counterbalance against a leading nation’s dominant whims. The recent Regional Comprehensive Economic Partnership agreement serves as evidence of this trend (Johnston, 2020).

Growth of Asian sovereign funds: These sovereign funds are best suited for long-term and large-scale infrastructure projects. In addition to India and China’s various large funds, Temasek of Singapore, Malaysia, and the Abu Dhabi Investment Authority are playing a crucial role in the future in Asia. Emerging markets of India, China, and Africa require massive investments that can only be undertaken by the sovereign funds. The expectation is that the Asia-Pacific region will need an additional infrastructure spending of $1.7 trillion annually to a total of $26 trillion by 2030 based on their current growth rates (HSBC, 2018).

Multiple currency reserves: During the 1980s, the Japanese bought most of the US debt; yet, the US government encouraged them to convert the public debt into private equity. To implement adequate measures, the Bank of Japan gave low/no-interest loans to the Keiretsu banks. These banks, in turn, encouraged manufacturing and investing in the United States rather than merely exporting. Various Japanese firms built plants in the United States, and they were allowed to buy equity. For example, they invested heavily in real estate.

Since the US debt ratio is not sustainable in the long run, countries such as China and India will need to convert their debt instruments (T-bonds) into equity. However, in India, western capital will be used to acquire Indian firms, which then can be leveraged to acquire the US and other western assets. To diversify risks, China will have to hold massive reserves in various currencies and gold, which is already happening. Chinese gold reserves which historically averaged 995 tons until 2019 were increased to 1936 tons average by the third quarter of 2019 (Trading Economics, 2019a). Similarly, over the same period, India’s gold reserves averaged 462 tons but grew to 618 tons by the second quarter of 2019 (Trading Economics, 2019b). In the future, currency wars will increasingly supplement trade wars, and the central banks will play an active role by shifting focus from fiscal to monetary policies.

Redefining capitalism and democracy: History as well as the prevailing ideology is shaped by the victors’ hands. Such was the definition of power through capitalism and the free markets by Adam Smith and David Ricardo during the mighty reign of Great Britain. The United States adopted the British definition of democracy as a parliamentary government consisting of two primary parties. Contrary to the United Kingdom, where people choose the party responsible for selecting the prime minister, replaceable through a vote of no confidence, the United States favors continuity and stability with a leader having a term of four years once elected as a president. Being a republic democracy, each state influences congress based on the electoral votes. Over the recent past, the divergence of popular versus electoral votes has significantly impacted the presidential elections.

With such a large “base of the pyramid” in global societies, with over a billion people living on less than $2 in a day, capitalism’s current definition is not sustainable. There is a need to implement a more participatory and nurturing capitalism other than that defined by the west, allowing the incorporation of all stakeholders rather than only shareholders. Corporate social responsibility by itself is not sufficient; a more egalitarian/equitable perception of shared value is necessary (Mackey & Sisodia, 2013; Porter & Kramer, 2011; Uslay, 2019; Uslay et al., 2009).

When extreme acrimony and gridlocks are allowed to persist, democracy can devolve into anarchy. Freedom to express an opinion without any form of regulatory check or balance makes it possible for the public sentiment to get out of control, more so with the amplification through social media (fake news spreads fast). However, the best resolution for such outcomes is self-discipline. The future requires a disciplined democracy which balances the rights of individuals with those of institutions. In autocratic nations, institutions dominate the country. The highly contested abortion law in the United States is an example of this where society dictates a critical decision over individual freedom.

Contrarily, pure democracy allowing individual rights to trump those of organizations and/or society also becomes impossible to sustain. United States’ gun legislation where individuals’ rights to bears arms are protected by the constitution can be considered an example. Institutions are as significant to society as its individual citizens are. As such, the rights of each should be effectively balanced to achieve a caring capitalism and disciplined democracy.

Both capitalism and democracy will be redefined with Chindia’s rise and the shifting center of gravity from the Atlantic to the Pacific Ocean. Following World War II, China relied on cheap labor, which rendered it a low-cost provider to the world in the 1990s, similar to Japan earlier:

As in Japan, that strategy was very successful in China for the next two decades…. But just as happened in Japan, China’s economic growth has led to higher wages, an increased standard of living, and they will eventually experience lower productivity from an aging population. (Sheth, 2011, p. iii)

Unlike the previous century, which was shaped by politics and ideologies, the 21st century will be redefined by competitive market and resources. The triad, consisting of China, America, and India, will command the 21st century. There will be stiff competition for global resource consolidation in the new geopolitical order, even as the continent of Africa is awakening to opportunities.

Understanding the Global Rule of Three can enable business and public leaders alike to navigate unchartered waters. Taking a historical view enables us to comprehend how the United States overtook the United Kingdom to claim the number 1 spot globally and why it will eventually find itself in the #3 spot after China and India. Like businesses, nations also have to choose between being a generalist or specializing in sectors for trade and investment. Those that fail to choose, do so at their own peril, as they risk getting stuck in the global ditch as one market after another evolves from national to global. Recall that the Rule of Three renews itself at every stage of a market’s geographic evolution and massive sums of value will be subject to creative destruction. Global markets will be subject to disruption in the interim until the global leaders emerge.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

Notes

Abi-Habib, M. (2018, June 25). How China got Sri Lanka to cough up a port. The New York Times. Retrieved September 27, 2019, from https://www.nytimes.com/2018/06/25/world/asia/china-sri-lanka-port.html

Beresnevicius, R. (2019, October 16). Flybe becomes Virgin Connect; a move crucial for Virgin Atlantic. Aerotime. Retrieved June 29, 2020, from https://www.aerotime.aero/rytis.beresnevicius/24075-flybe-virgin-connectpage=1

Bhatti, Y., Basu, R. R., Barron, D., & Ventresca, M. J. (2018). Frugal innovation: Models, means, methods. Cambridge University Press.

Blackrock Investment Institute. (2019, April). Getting physical: Scenario analysis for assessing climate-related risks. Global Insights. Retrieved October 5, 2019, from https://www.blackrock.com/ch/individual/en/literature/whitepaper/bii-physical-climate-risks-april-2019.pdf

Brucker, D. (2018, November 14). 50 recycling & trash statistics that will make you think twice about your trash. Rubicon. Retrieved September 27, 2019, from https://www.rubicon.com/blog/statistics-trash-recycling/.https://www.rubiconglobal.com/blog-statistics-trash-recycling/

Chandran, N. (2017, December 13). India and China compete for control of an almost empty Sri Lanka Airport. CNBC. Retrieved September 27, 2019, from https://www.cnbc.com/2017/12/13/india-and-china-rivals-compete-for-control-of-empty-sri-lanka-airport.html

Chandran, N. (2019, January 17). Fears of excessive debt drive more countries to cut down their belt and road investments. CNBC. Retrieved September 27, 2019, from https://www.cnbc.com/2019/01/18/countries-are-reducing-belt-and-road-investments-over-financing-fears.html

Cheng, A. (2018, July 31). Will Djibouti become latest country to fall into China’s debt trap Foreign Policy. Retrieved September 27, 2019, from https://foreignpolicy.com/2018/07/31/will-djibouti-become-latest-country-to-fall-into-chinas-debt-trap/

Cortes, M. S. (2020, May 14). It’s not you, grocery prices are going up. Refinery29. Retrieved July 12, 2020, from https://www.refinery29.com/en-us/2020/05/9816335/grocery-prices-rising-more-expensive-coronavirus-impact

Fenstermaker, S. (2013, August 31). Too much choice: The jam experiment. Retrieved September 24, 2019, from https://peopletriggers.wordpress.com/2013/08/31/too-much-choice-the-jam-experiment/

Gertz, B. (2019, July 24). U.S. sides with Vietnam in maritime dispute with China. The Washington Free Beacon. Retrieved September 27, 2019, from https://freebeacon.com/national-security/u-s-sides-with-vietnam-in-maritime-dispute-with-china/

Global Policy Forum. (2006, January 2006). US territorial acquisition. Retrieved September 27, 2019, from https://www.globalpolicy.org/component/content/article/155/25993.html

Goel, V. (2017, September 28). IBM now has more employees in India than in the U.S. The New York Times. Retrieved September 27, 2019, from https://www.nytimes.com/2017/09/28/technology/ibm-india.html

Henderson, B. D. (1979). Henderson on corporate strategy. Abt Books.

Howard, J., & Sheth, J. N. (1969). The theory of buyer behavior. John Wiley & Sons.

HSBC. (2018, March 6). Where is the funding for a $26 trillion initiative coming from CNBC. Retrieved September 27, 2019, https://www.cnbc.com/advertorial/2018/03/06/where-is-the-funding-for-a-26-trillion-initiative-coming-from.html

Huck, S., Normann, H.-T., & Oechssler, J. (2004). Two are few and four are many: Number effects in experimental oligopolies. Journal of Economic Behavior & Organization, 53 (4), 435–446.

Husseini, T. (2018, October 2), Hot prospects: The biggest mining mergers to rock the industry. Mining Technology. Retrieved September 27, 2019, from https://www.mining-technology.com/features/biggest-mining-mergers/

Johnston, E. (2020, November 15). What does RCEP mean for Japan and its Asian Neighbours The Japan Times. Retrieved November 15, 2020, from https://www.japantimes.co.jp/news/2020/11/15/national/politics-diplomacy/rcep-japan-asia-trade/

Knoema. (2020). Gross domestic product based on purchasing-power-parity in current prices (IMF World Economic Outlook, April 2020).

Kuo, F. (2018, November 29), G20: The evolution and expansion of the international summit. CGTN America. Retrieved September 27, 2019, from https://america.cgtn.com/2018/11/29/g20-the-evolution-and-expansion-of-the-international-summit

Liu, Y., & Wang, O. (2019, April 23). China’s African swine fever crisis ‘Very Serious’ with stocks falling and pork prices set to hit all-time high. South China Morning Post. Retrieved September 27, 2019, from https://www.scmp.com/economy/china-economy/article/3007359/chinas-african-swine-fever-crisis-very-serious-stocks-falling

Mackey, J., & Sisodia, R. S. (2013). Conscious capitalism: Liberating the heroic spirit of business. Harvard Business Review Press.

Malhotra, N. K., & Uslay, C. (2018). Make, buy, borrow or crowdsource The evolution and future of outsourcing. Journal of Business Strategy, 39(5), 14–21.

McKenna, P. (2019, August 14). Global warming is worsening China’s pollution problems, studies show. Inside Climate News. Retrieved October 5, 2019, from https://insideclimatenews.org/news/14082019/climate-change-china-pollution-smog-soot-jet-stream-global-warming

Ming, C. (2018, March 5). China’s mammoth belt and road initiative could increase debt risk for 8 countries. CNBC. Retrieved September 27, 2019, from https://www.cnbc.com/2018/03/05/chinas-belt-and-road-initiative-raises-debt-risks-in-8-nations.html

Mourdoukoutas, P. (2018, May 6). Why Alibaba is more profitable than Amazon. Forbes. Retrieved September 27, 2019, from https://www.forbes.com/sites/panosmourdouk outas/2018/05/06/why-alibaba-is-more-profitable-than-amazon/#5e6862f21678

Ohmae, K. (1985). Triad power: The coming shape of global competition. MacMillan-Free Press.

Phadnis, S. (2018, July 26). Accenture new revenue catches up with top five Indian IT firms. The Times of India. Retrieved September 27, 2019, from https://timesofindia.indiatimes.com/business/india-business/accenture-says-india-employees-have-to-specialise-or-go/articleshow/65144526.cms

Pomroy, M. (2014, May 21). Why are Gulf States buying land in Africa Esquire Middle East. Retrieved September 27, 2019, from https://www.esquireme.com/brief/business/why-are-gulf-states-buying-land-in-africa

Porter, M. E., & Kramer, M. R. (2011, January–February). Creating shared value. Harvard Business Review, 62–77.

Reeves, M., Daimler, M., Stalk, G., & Scognamiglio, F. L. (2012). BCG classics revisited: The rule of three and four. BCG Perspectives, #468. https://www.bcg.com/publications/2012/business-unit-strategy-the-rule-of-three-and-four-bcg-classics-revisited

Sheth, J. N. (2011). Chindia rising: How China and India will benefit your business (2nd ed.). Tata-McGraw Hill India.

Sheth, J. N., Allvine, F. C., Uslay, C., & Dixit, A. (2007). Deregulation and competition: Lessons from the airline industry. SAGE Publications.

Sheth, J. N., & Sisodia, R. S. (2002). The rule of three: Surviving and thriving in competitive markets. The Free Press.

Sheth, J. N., & Sisodia, R. S. (2006). Tectonic shift: The geoeconomic realignment of globalizing markets. Response.

Sheth, J. N., Uslay, C., & Sisodia, R. S. (2021). The Global Rule of Three: Competing with conscious strategy. Palgrave Macmillan.

Suhas, A., & Sheth, J. N. (2016). The sustainability edge: How to drive top-line growth with triple-bottom-line thinking. University of Toronto Press.

Tanzi, A., & Lu, W. (2020, October 16). IMF data shows Coronavirus will push China GDP growth well beyond U.S. The Economic Times. Retrieved November 9, 2020, from https://economictimes.indiatimes.com/news/international/business/imf-data-shows-coronavirus-will-push-china-gdp-growth-well-beyond-us/articleshow/78686778.cmsfrom=mdr

The American Chamber of Commerce in Shanghai. (2018, April). Chasing innovation: R&D barriers and incentives in China. Viewpoint. Retrieved September 27, 2019, from https://www.amcham-shanghai.org/sites/default/files/2018-04/R%26D%20viewpoint%202018%20April%20Final%20EN_0.pdf

The Economic Times. (2019, January 23). TCS 3rd most-valued IT services brand globally: Brand finance. IndiaTimes.com. Retrieved September 27, 2019, from https://economictimes.indiatimes.com/tech/ites/tcs-3rd-most-valued-it-services-brand-globally-brand-finance/articleshow/67660948.cms

Trading Economics. (2019a). China gold reserves. Retrieved September 28, 2019, from https://tradingeconomics.com/china/gold-reserves

Trading Economics. (2019b). India gold reserves. Retrieved September 28, 2019, from https://tradingeconomics.com/india/gold-reserves

Uslay, C. (2015a). The Rule of Three: Market structure and performance. In D. M. Hanssens (ed.), Empirical generalizations about marketing impact (p. 16). Marketing Science Institute.

Uslay, C. (2015b). The Rule of Three: Market share and performance. In D. M. Hanssens (ed.), Empirical generalizations about marketing impact (pp. 17–18). Marketing Science Institute.

Uslay, C. (2019). The next frontier in marketing: Self-sustaining marketing, society, and capitalism through collaborative yet disruptive partnerships. In A. Parvatiyar & R. S. Sisodia (eds.), Handbook of marketing advances in the era of disruptions – Essays in honor of Jagdish N. Sheth (pp. 490–500). SAGE Publications.

Uslay, C., Altintig, Z. A., & Winsor, R. D. (2010). An empirical examination of the “Rule of Three”: Strategy mplications for top management, marketers, and nvestors. Journal of Marketing, 74(March), 20–39.

Uslay, C., Karniouchina, E. V., & Altintig, Z. A. (2020). Caveat regarding empirical generalizations: The case of market share and financial performance (Working paper).

Uslay, C., Karniouchina, E. V., Altintig, Z. A., & Reeves, M. (2017). (How) do businesses get stuck in the middle (Working paper). https://papers.ssrn.com/sol3/papers.cfmabstract_id=3043330

Uslay, C., Morgan, R. E., & Sheth, J. N. (2009). Peter Drucker on marketing: An exploration of five tenets. Journal of the Academy of Marketing Science, 37(1), 47–60.

World Bank. (2018, March 29). Belt and road initiative. WorldBank.org. Retrieved September 27, 2019, from http://www.worldbank.org/en/topic/regional-integration/brief/belt-and-road-initiative

Yamado, G. (2015, July 6). Multinationals recognize India’s potential as global R&D hub. Nikkei.com. Retrieved September 27, 2019, https://asia.nikkei.com/Business/Multinationals-recognize-India-s-potential-as-global-R-D-hub