1 Department of Economics, University of Kashmir, Srinagar, Jammu and Kashmir, India

2 Centre for Distance and Online Education, University of Kashmir, Srinagar, Jammu and Kashmir, India

This study investigates the determinants of foreign exchange reserves in India using quarterly data from 2000Q1 to 2020Q4. Employing a structured two-stage framework, the analysis first derives a long-run money demand function through the ARDL bound testing approach, from which a domestic money market disequilibrium term is generated. This term is then integrated into the short-run reserve demand function using an unrestricted error-correction model. The empirical findings reveal that the average propensity to import exerts a strong negative long-run effect on reserves (elasticity: –1.21), while foreign portfolio investment (elasticity: 0.51) and short-term external debt (elasticity: 0.55) have significant positive effects. In the short run, money market disequilibrium negatively influences reserves (coefficient: –1.02), with an error-correction adjustment speed of 11% per quarter. Reserve adequacy diagnostics further confirm that by 2020, India’s reserves covered 12 months of imports, exceeded short-term external debt by a factor of more than two and represented over 20% of broad money supply, far surpassing international adequacy thresholds. These results demonstrate that India’s reserve accumulation, though precautionary in nature, has generated a consistent surplus beyond conventional benchmarks. The study concludes that such surplus reserves can be strategically redeployed towards external debt reduction and high-return domestic investments, thereby optimising the balance between precautionary holdings and development financing. In doing so, the findings highlight important societal benefits, including enhanced macroeconomic stability, reduced fiscal costs and the creation of fiscal space for health, education and infrastructure, consistent with the objectives of sustainable growth. By integrating updated evidence with actionable policy recommendations, this article contributes to the discourse on dynamic reserve management in emerging economies.

Economic and business policy, financial economics, international management, policy

Introduction

Foreign exchange reserves constitute a cornerstone of macroeconomic stability and resilience for emerging economies such as India. According to the International Monetary Fund (IMF, 2013), foreign exchange reserves include foreign currency assets, gold, special drawing rights and a nation’s reserve position with the IMF—assets that are readily available to the monetary authority for external obligations and market interventions. Beyond their immediate financial role, reserve management also connects to broader sustainability objectives. In particular, the strategic redeployment of surplus reserves can contribute to the Sustainable Development Goals (SDGs), especially SDG 8 (promoting sustained, inclusive and sustainable economic growth), SDG 9 (building resilient infrastructure and fostering innovation) and SDG 17 (strengthening global financial partnerships and stability). This study addresses the problem of excess reserve accumulation, which, while enhancing stability, imposes fiscal and opportunity costs. By analysing the determinants of reserves and evaluating adequacy benchmarks, this article presents solutions that allow for optimising the balance between precautionary holdings and growth-oriented investments. This represents the unique contribution of the study: integrating advanced econometric evidence with sustainability-linked policy recommendations.

Historically, under the Bretton Woods system of fixed exchange rates, reserves played a pivotal role in maintaining currency pegs. Although the system collapsed in the early 1970s and most economies transitioned to more flexible or managed float regimes, global reserve holdings have continued to grow substantially. India exemplifies this paradoxical trend. Following the adoption of a market-determined exchange rate system in March 1993, India’s foreign exchange reserves had surged from approximately US$9.8b to over US$550b by February 2022, positioning the country among the top reserve holders globally. This rapid accumulation reflects multiple objectives, including safeguarding against external shocks, maintaining orderly exchange rate conditions and supporting policy credibility.

Theoretical frameworks suggest that under a freely floating exchange rate system, reserves should be minimal, as currency values adjust automatically through market forces. Conversely, fixed or managed exchange rate regimes necessitate higher reserves to manage currency stability. Despite India’s managed float regime, its reserves have persistently exceeded traditional adequacy thresholds, prompting debate over the factors driving this accumulation and the optimal level of reserves.

Existing studies have examined the determinants of India’s foreign exchange reserves, often incorporating macroeconomic variables such as trade openness, capital flows and opportunity costs. Some have explored the role of domestic money market disequilibrium in explaining reserve fluctuations (Mishra & Sharma, 2011; Nayak & Baig, 2019). However, much of this literature relies on outdated data sets and does not capture the significant macroeconomic transformations India has undergone in the past decade, including heightened capital mobility, policy reforms and unprecedented reserve growth post the global financial crisis and during the COVID-19 period. To address this limitation, the present study employs an updated quarterly data set covering the period from 2000Q1 to 2020Q4, enabling a re-examination of reserve dynamics in light of recent economic developments. Methodologically, the present study adopts a structured two-stage approach: first, a domestic money market disequilibrium variable is derived from an estimated long-run money demand function; second, this measure is integrated into both long-run and short-run reserve demand models using the ARDL bound testing and unrestricted error-correction model (UECM) frameworks. Furthermore, the study evaluates India’s reserve adequacy against established international benchmarks, providing quantitative evidence of surplus holdings.

The objective of the study is to examine both the long-run and short-run determinants of reserves, explicitly incorporating domestic money market disequilibrium into an ARDL–UECM framework. The novelty lies in three contributions: first, the use of quarterly data spanning 2000–2020, which allows for the inclusion of the post–global financial crisis, recent policy reforms and the COVID-19 period; second, the explicit modelling of monetary disequilibrium within a unified econometric structure to assess both equilibrium and adjustment dynamics; and third, the integration of econometric findings with reserve adequacy diagnostics to provide actionable policy recommendations on optimal reserve deployment. Collectively, these contributions advance the literature by offering updated empirical evidence and by linking reserve dynamics to practical strategies for economic management in emerging markets.

Adequacy of Foreign Exchange Reserves in India

Over the past three decades (1991–2020), India’s foreign exchange reserves have expanded substantially, reflecting a deliberate strategy to strengthen external sector resilience and safeguard against global financial volatility. The literature identifies several well-established benchmarks to assess whether a country’s reserve holdings are adequate relative to its potential external vulnerabilities. This section evaluates India’s reserves against three commonly accepted adequacy indicators: the import cover ratio, the ratio of reserves to short-term external debt and the ratio of reserves to broad money supply.

Reserves in Terms of Months of Imports

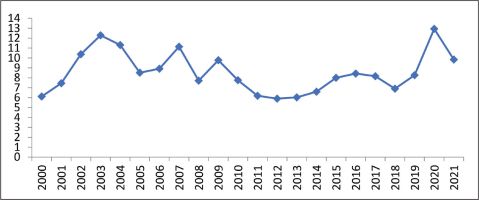

A widely used rule-of-thumb for reserve adequacy is the number of months of imports that reserves can cover. This measure accounts for a country’s dependence on external trade and its susceptibility to external shocks. Although there is no universal benchmark, economists generally consider reserves equivalent to at least 3–6 months of imports to be sufficient for meeting short-term external obligations and maintaining market confidence (Mishra & Sharma, 2011). As shown in Figure 1, India’s import cover has consistently exceeded this minimum standard since 2000. By 2020, country’s reserves were sufficient to cover approximately 12 months of imports, providing a substantial buffer against trade and capital flow shocks.

Figure 1. Foreign Exchange Reserves in Terms of Months of Imports.

Source: World Development Indicators, World Bank.

Ratio of Reserves to Short-term External Debt

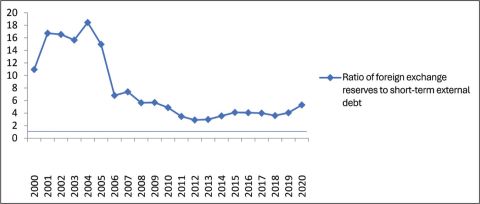

For countries with significant exposure to international borrowing, the ratio of reserves to short-term external debt serves as a critical indicator of liquidity risk. Short-term debt is particularly vulnerable to sudden stops or reversals in capital flows, making this ratio a key gauge of a country’s ability to withstand external financing pressures (Bird & Rajan, 2003). According to the Greenspan–Guidotti rule, a country should maintain reserves at least equal to its short-term external debt to safeguard against rollover risks (Jeanne, 2007; Mishra & Sharma, 2011). Figure 2 illustrates that since 2000, India’s reserves have consistently remained above this threshold. Although the ratio has declined since its peak in 2004, it has consistently stayed above 1, indicating a sound liquidity position and sustaining investor confidence.

Figure 2. Ratio of Foreign Exchange Reserves to Short-term External Debt.

Source: World Development Indicators, World Bank.

Ratio of Reserves to Broad Money (M3)

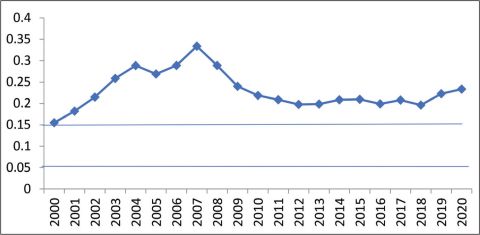

Another useful measure of reserve adequacy is the ratio of reserves to broad money supply (M3). This ratio reflects the degree of exposure to rapid capital flight, as broad money represents the domestic liquidity that could potentially be converted into foreign assets during periods of financial stress. Calvo and Mendoza (1996) suggest that a ratio in the range of 5%–15% is typically considered adequate to mitigate currency and banking crises. Figure 3 demonstrates that India’s reserves have remained well above this benchmark range since 2000, underscoring the strength of its external position relative to the size of its domestic monetary base.

Figure 3. Ratio of Foreign Exchange Reserves to Broad Money.

Source: Reserve Bank of India.

Together, these standard metrics confirm that India’s foreign exchange reserves not only meet but significantly exceed traditional adequacy norms, highlighting a consistent policy preference for maintaining a robust buffer against external shocks. This surplus suggests an opportunity for policymakers to explore more efficient allocations of excess reserves to support domestic development priorities and reduce the economic cost of holding large reserve stocks.

Literature Review

The accumulation of foreign exchange reserves has attracted wide academic attention, and the literature can broadly be grouped into four themes: precautionary motives, mercantilist motives, institutional and structural determinants, and country-specific evidence. This thematic classification enables a critical synthesis of existing research while identifying the specific gaps addressed by the present study.

Precautionary Motives

A large strand of literature views reserves primarily as a buffer stock against external shocks, sudden stops in capital flows or balance-of-payments crises. Aizenman and Lee (2007) demonstrated that reserves rise significantly in response to crisis indicators, trade openness and financial volatility, confirming the importance of precautionary motives in emerging markets. Cheung et al. (2019) extended this argument to the regional context, showing that countries often accumulate reserves in response to the behaviour of their peers—a phenomenon they called the ‘Joneses effect’. In the Indian context, Prabheesh et al. (2007) used an ARDL framework and found that both precautionary and mercantilist motives were statistically significant, but the precautionary motive was particularly relevant due to the volatility of portfolio flows. Similarly, Mishra and Sharma (2011) showed that monetary disequilibrium, in combination with precautionary factors, explained India’s reserve accumulation under the floating regime. These studies highlight the dominant role of precautionary accumulation but leave open questions about how disequilibrium interacts with external determinants over longer time horizons.

Mercantilist Motives

Another influential strand interprets reserve accumulation as a deliberate strategy to support export competitiveness and resist exchange rate appreciation. Ford and Haung (1994) demonstrated for China that reserve demand was closely tied to trade performance and the average propensity to import (API). Aizenman and Lee (2007) found that deviations from purchasing power parity and export growth reinforced mercantilist accumulation.

For India, Prabheesh et al. (2007) found robust evidence of mercantilist motives during the early liberalisation phase, suggesting that policymakers used reserves to maintain competitiveness in global markets. Pontines and Rajan (2011) further showed that many Asian central banks intervened in foreign exchange markets to prevent appreciation, thereby contributing to persistent reserve build-up. Collectively, these studies underscore the mercantilist interpretation of reserves as a policy tool for trade and currency management. However, the relative strength of this motive in more recent years remains contested, particularly in the context of large-scale capital inflows.

Institutional and Structural Determinants

A growing body of research highlights the role of institutional quality, financial liberalisation and structural reforms in shaping reserve demand. Law et al. (2021) provided cross-country evidence that institutional quality exhibits a nonlinear relationship with reserves: accumulation initially rises with improvements in institutions but declines beyond a certain threshold. Aizenman and Marion (2003) and Ramachandran (2004) emphasised that adjustment costs, policy credibility and risk perceptions act as structural determinants of reserve demand, beyond trade and financial variables.

For South Asia, Nayak and Baig (2019) provided important evidence on the role of money market disequilibrium, showing that imbalances in domestic liquidity significantly influenced reserve holdings in both India and China. Dominguez et al. (2012) argued that emerging-market central banks prioritise stability over opportunity costs when deciding on reserve levels, underscoring the institutional and credibility dimensions of accumulation. This line of work highlights that reserve dynamics cannot be understood purely in terms of macroeconomic flows but must also account for institutional frameworks and policy choices.

Country-specific Evidence

Country-focused studies provide further nuance by highlighting context-specific determinants. For China, Ford and Haung (1994) documented the role of monetary disequilibrium and imports in shaping reserves. For Bangladesh, Chowdhury et al. (2014) found strong relationships between reserves, remittances, the exchange rate and domestic interest rates, while foreign aid was insignificant. In Sri Lanka, Kashif and Sridharan (2020) reported that trade deficits and external debt pressures constrained reserve accumulation. For India, Mishra and Sharma (2011) found that monetary disequilibrium played a central role, while Nayak and Baig (2019) highlighted the joint role of disequilibrium and external flows in explaining reserve dynamics. These country-level studies reinforce the view that determinants vary with institutional setting, external exposure and domestic macroeconomic structures.

Synthesis and Gaps

Taken together, the literature provides valuable insights but also leaves important gaps. While precautionary and mercantilist motives are well established, their relative strength in the Indian context during the past two decades of capital liberalisation remains underexplored. Similarly, although monetary disequilibrium has been included in some models, it has rarely been systematically integrated into both long- and short-run frameworks. Moreover, much of the existing evidence relies on outdated data sets, often ending before the global financial crisis or excluding the COVID-19 period, thereby missing major structural changes in India’s external sector.

The present study addresses these limitations by employing quarterly data up to 2020, explicitly deriving a money market disequilibrium variable and examining its role alongside traditional determinants in both the ARDL long-run framework and the UECM short-run model. Further, by incorporating reserve adequacy diagnostics, the study links econometric evidence to sustainability-oriented policy recommendations, thereby advancing the discourse on dynamic reserve management in emerging economies.

Data Sources

This study utilises quarterly data spanning the period from the first quarter of 2000 (2000Q1) to the fourth quarter of 2020 (2020Q4). Data on foreign exchange reserves (ir), broad money (m3), imports, gross domestic product (GDP), domestic interest rate (r) and exchange rate (er) were obtained from the Federal Reserve Bank of St. Louis (FRED) database. In addition, data on foreign portfolio investment (fpi) and short-term external debt (STED) were sourced from the Reserve Bank of India’s Handbook of Statistics on the Indian Economy.

Prior to conducting the econometric analysis, all variables—except for the opportunity cost—were transformed into their natural logarithmic form.

Methodology

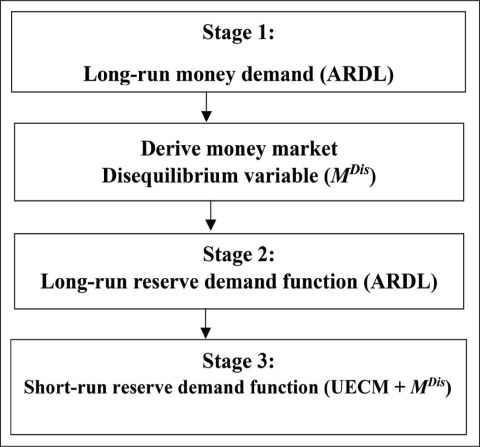

The empirical analysis is conducted in three stages to systematically capture the long-run and short-run determinants of India’s foreign exchange reserves and to account explicitly for the role of domestic money market disequilibrium. For clarity, Figure 4 provides a graphical summary of the three-stage empirical methodology adopted in this study.

Figure 4. Graphical Summary of the Three-stage Empirical Methodology Adopted in This Study.

In Stage 1, a long-run money demand function is estimated using the ARDL framework to derive a domestic money market disequilibrium variable (MDis). In Stage 2, a long-run reserve demand function is estimated using ARDL bound testing. In Stage 3, the short-run reserve demand function is modelled within a UECM framework, explicitly incorporating the disequilibrium term.

Long-run Money Demand Function and National Money Market Disequilibrium (Stage 1)

According to the classical quantity theory of money, the demand for nominal money balances is primarily determined by three variables: income, the general price level and the interest rate. Specifically, the demand for nominal money balances is assumed to be a positive function of income and the price level, and a negative function of the interest rate. In empirical applications, it is common practice to model the demand for real money balances as positively related to real income and inversely related to the interest rate. Consistent with this theoretical framework and empirical literature, the long-run money demand function in this study is specified using the ARDL approach proposed by Edwards (1984).

(1)

(1)

where Mt is broad money stock (M3), GDPt is real output, rt is domestic short-term interest rate, ERt is nominal exchange rate (INR/USD) and ut is error term. The fitted value represents equilibrium money demand, M*t.

From this model, the money market disequilibrium term is derived as the deviation of actual money supply from its estimated demand. The specification is as follows:

(2)

(2)

where MDist represents the money market disequilibrium in period t.

We retain the level form consistent with ARDL residuals. A log-deviation version yields similar results.

In line with the standard monetary and international finance literature, the expected signs of the model variables can be explained as follows. The coefficient on income (GDPt) is expected to be positive, since rising income increases transaction demand for money as individuals and businesses engage in more consumption and investment. Conversely, the interest rate (rt) is anticipated to have a negative sign, reflecting the higher opportunity cost of holding money when returns on alternative assets rise. The exchange rate (ERt) carries an ambiguous sign: depreciation may increase domestic money demand through a wealth effect (rising value of foreign assets) but can also lower demand through currency substitution if agents switch into foreign currency holdings.

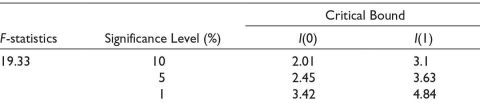

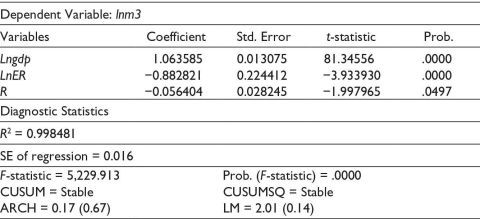

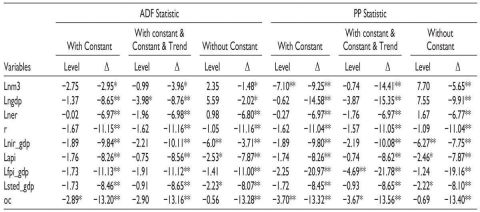

The long-run money demand function is estimated using the ARDL bound testing approach, which allows for a mix of stationary and non-stationary regressors and provides robust estimates of both long-run relationships and short-run dynamics. The results of the unit root tests indicate that all variables are integrated of order one, I(1), and are given in Table A1. The existence of a long-run relationship among the variables is confirmed by the computed F-statistic from the bound test (Table 1).

Table 1. Bound Test for Existence of Long-run Relationship Among Variables Included in Money Demand Function.

The value of F-statistic is 19.33, which lies above the upper critical bound. It means there exists a long-run relationship between money demand and its determinants. The long-run results of ARDL model are reported in Table 2.

Table 2. ARDL Results of Long-run Money Demand Function.

The estimated long-run money demand function confirms that all variables are stationary and exhibit signs consistent with theoretical expectations. Specifically, the coefficient of the ER is negative, indicating that a depreciation of the domestic currency tends to increase expectations of further depreciation, prompting economic agents to substitute domestic currency holdings with foreign currencies. This finding aligns with the results reported by Bahmani-Oskooee and Poorheydarian (1990), who have also documented evidence supporting the currency substitution effect in open economies.

Long-run Reserve Demand Function (ARDL) (Stage 2)

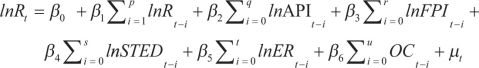

In the second stage, the long-run reserve demand function is estimated. Consistent with the theoretical framework, the money market disequilibrium term is excluded from the long-run model, as it is assumed to have only short-run transitory effects. The long-run reserve demand function (ARDL model) specified in this study is as follows:

(3)

(3)

where lnR is log of reserves/GDP, lnAPIt is log of imports/GDP, lnFPIt is log of portfolio inflows/GDP, lnSTEDt is log of short-term external debt/GDP, lnERt is log of exchange rate, OCt is opportunity cost (interest rate differential, % points) and εt is error term.

In the literature, countries accumulate foreign exchange reserves for multiple reasons, commonly categorised as transaction, precautionary and mercantilist motives. To capture the transaction motive, the API is included in the model. The expected sign of API can be either positive or negative, depending on its impact on the trade balance. If an increase in API is associated with a trade surplus—where export growth outpaces import growth, it can contribute to higher reserve accumulation. Conversely, if rising API leads to a trade deficit, it can exert downward pressure on reserves. Thus, the net effect of API on reserve holdings is conditional on the country’s trade balance dynamics.s

To capture the precautionary motive, foreign portfolio investment (FPI) and STED are incorporated as explanatory variables. Portfolio inflows are typically volatile, and countries often accumulate reserves as a safeguard against sudden capital flight; hence, the expected sign for FPI is positive. Similarly, STED represents a potential source of external vulnerability: higher short-term debt obligations increase the need for reserves to mitigate rollover risk and liquidity crises, implying a positive expected sign for this variable as well.

The exchange rate (ER) variable is included to account for currency substitution and valuation effects, while the opportunity cost (OC) reflects the foregone return from holding reserves relative to alternative assets. The effect of the ER on reserves is again theoretically ambiguous: depreciation may trigger precautionary accumulation but can also induce capital flight. Finally, the OC of holding reserves is expected to be negative, since higher interest differentials make reserve accumulation costlier relative to domestic investment opportunities.

Remittances, while important for India’s external balance, are relatively stable and countercyclical compared to portfolio flows and short-term debt. Several studies (e.g., Chami et al., 2008; IMF, 2016) show that remittances primarily support household consumption and are less volatile, reducing their direct role in shaping precautionary reserve demand. Similarly, global oil price shocks are an important determinant of the trade balance; however, their effect is already captured indirectly through the imports-to-GDP ratio (API), which includes India’s substantial oil import bill. Including both oil prices and API would risk multicollinearity and redundancy. For these reasons, remittances and oil price shocks were excluded to maintain a parsimonious specification while focusing on the core determinants most directly related to precautionary and financial stability motives.

The long-run relationship between reserve demand and its determinants is assessed using the ARDL bound testing approach. The computed F-statistic is reported in Table 3.

Table 3. Bound Test for Existence of Long-run Relationship Among Variables Included in Reserve Demand Function.

The value of F-statistic is 12.89, which lies above the upper critical bound. There exists long-run relationship between reserves and their determinants. Then, the long-run reserve demand model has been estimated by ARDL, and the results are reported in Table 4.

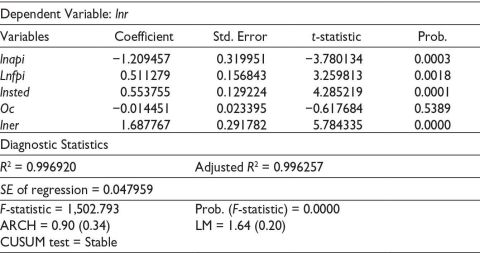

Table 4. ARDL Results of Long-run Reserve Demand Function.

The empirical results indicate that all explanatory variables, except for the OC, are statistically significant and exhibit the expected signs. This suggests that the Reserve Bank of India’s decision to hold foreign exchange reserves is motivated primarily by the need to safeguard macroeconomic stability and provide a buffer against external shocks, rather than by considerations of potential alternative returns from investing these reserves abroad.

The coefficient of API (lnapi) is -1.209, which is statistically significant at the 1% level (p = .0003). This negative relationship implies that an increase in the API is associated with a decline in foreign exchange reserves in the long run. The negative and significant coefficient of API is in line with the findings of Chakrabarty and Bordoloi (2013), who argue that higher imports increase the current account deficit, thereby reducing the capacity for reserve accumulation. The coefficient of foreign portfolio investment (lnfpi) is positive, implying that higher portfolio inflows are associated with higher reserves. This is due to precautionary motive of accumulating reserves as insurance against volatile capital flows. These results are in line with the findings of Aizenman and Lee (2007) and Mohanty and Turner (2006).

The insignificance of OC variable aligns with the findings of Dominguez et al. (2012), who emphasise that in emerging markets, central banks prioritise macroeconomic stability over OC considerations.

Diagnostic tests confirm that the residuals are free from both autocorrelation and heteroscedasticity. This indicates that the estimated model adequately captures the underlying dynamics of the data and that the residuals do not display any systematic patterns or variance instability that would undermine the reliability of the results.

Short-run Reserve Demand Function (UECM +MDis) (Stage 3)

Finally, the short-run reserve demand function is estimated by incorporating the money market disequilibrium term along with the short-run dynamics of the other determinants. The short-run UECM is a statistical model that combines the short-run dynamics of the variables with their long-run equilibrium relationship. The ordinary least squares (OLS) approach has been used for estimating the parameters of the short-run UECM and follows the specification:

(4)

(4)

where Δ is the first difference operator, Xj,t is the vector of logged regressors (lnAPI, lnFPI, lnSTED, lnER);),; OCt is included as appropriate, MDist – 1 is the lagged disequilibrium, ECTt–1 is the lagged error-correction term from Equation (3) and ηt is the error term.

ψ measures the speed of adjustment; that is, ψ measures the speed at which deviations from equilibrium are corrected. In other words, it measures the extent to which changes in the foreign exchange reserves are influenced by its past deviations from its long-run equilibrium relationship with one or more independent variables.

The money market disequilibrium measure (MDist) is expected to exert a negative effect on reserves, as excess liquidity in the domestic money market tends to pressure the balance of payments and lower reserve holdings, whereas the error-correction term (ECTt) is anticipated to be negative, capturing the speed of adjustment back to long-run equilibrium.

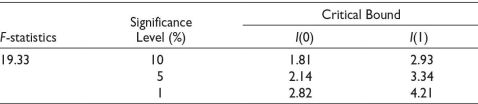

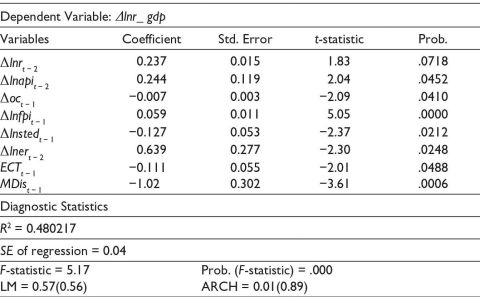

The short-run results estimated from OLS approach are shown in Table 5.

Table 5. Short-run Reserve Demand Model with Monetary Disequilibrium.

The short-run results indicate that all explanatory variables are statistically significant, highlighting their relevance in explaining fluctuations in foreign exchange reserves over shorter time horizons. The coefficient of the error-correction term (ECT) is –0.11, suggesting that approximately 11% of the previous period’s disequilibrium is corrected in each quarter. This moderate speed of adjustment implies that deviations from the long-run equilibrium are gradually realigned over time through adjustments in reserve holdings.

The coefficient of the money market disequilibrium variable is negative and statistically significant. This indicates that imbalances in the money market—where the supply of money exceeds or falls short of demand—have a direct effect on foreign exchange reserves in the short run. In cases of excess money supply, declining interest rates may render the domestic currency less attractive to foreign investors, thereby reducing capital inflows and exerting downward pressure on foreign exchange reserves. This finding supports the theoretical expectation that money market imbalances can influence currency markets and reserve behaviour through interest rate channels.

One unexpected finding in the short-run model is the negative and statistically significant coefficient of STED. While theory suggests that higher short-term liabilities should increase the demand for reserves as a precautionary buffer, the short-run dynamics in India appear to operate differently. A plausible explanation is that sudden increases in short-term debt obligations may undermine investor confidence in the economy’s external sustainability. In such cases, rather than prompting precautionary reserve accumulation, rising STED may trigger capital outflows, currency depreciation pressures and downward movements in reserves. This interpretation is consistent with the literature on ‘sudden stops’ and external vulnerability (Calvo, 1998; Rodrik & Velasco, 1999), which emphasises that markets may perceive sharp increases in short-term debt as a signal of fragility, thereby worsening reserve positions in the short term.

In India’s case, the negative short-run effect of STED likely reflects these risk perceptions. However, the positive and significant long-run relationship between STED and reserves remains intact, supporting the view that policymakers eventually respond to higher debt obligations by building up reserves as an insurance mechanism. This combination of short-run vulnerability and long-run precautionary adjustment highlights the dual role of reserves in emerging markets: while markets may react negatively to sudden debt surges in the short run, central banks act over time to restore confidence by strengthening reserve buffers.

Diagnostic Tests

To ensure the reliability of the estimated models, a series of diagnostic tests were conducted. Standard residual diagnostics confirmed the absence of autocorrelation and heteroscedasticity, while the Jarque–Bera test supported normality of residuals.

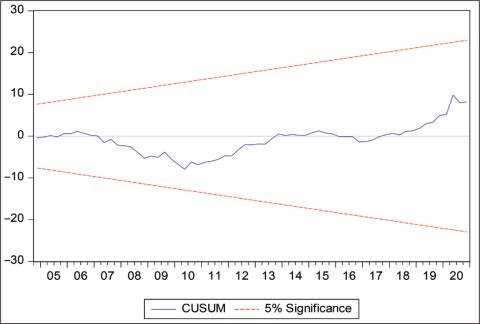

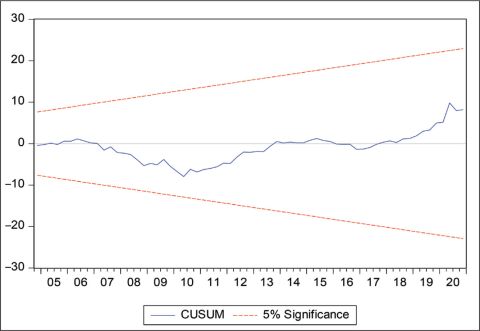

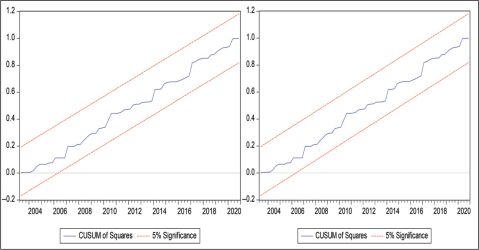

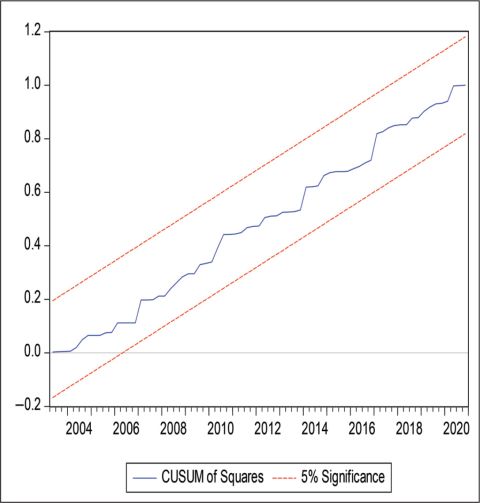

In addition, parameter stability was examined using the CUSUM and CUSUM of squares (CUSUMQ) tests. For both the long-run money demand function and the reserve demand function, the test statistics remained within the 5% significance bounds, thereby confirming the stability of the estimated coefficients and the absence of structural instability over the sample period. The graphical plots of these stability diagnostics are presented in Figure B1,Figure B2, Figure B3,Figure B4.

Together, these results validate that the estimated ARDL specifications are econometrically sound and robust, providing a solid basis for interpreting both the long-run and short-run relationships identified in this study.

The evaluation of the determinants of foreign exchange reserves carries important societal implications. By identifying the role of monetary disequilibrium, trade performance and capital flows, this study contributes to policies that enhance macroeconomic stability, which in turn protects employment, ensures affordable imports of essential goods and shields the economy from disruptive crises. Furthermore, the findings on reserve adequacy inform decisions on the optimal use of surplus reserves. Reallocating excess reserves towards external debt reduction and productive domestic investment can lower fiscal burdens, free resources for priority social sectors such as health and education, and stimulate infrastructure development. In this way, the research not only advances the academic literature but also generates actionable insights that align with societal welfare and long-term sustainable development.

To situate the results in a broader context, this sub-section highlights the research problems addressed, the solutions offered by the findings and the theoretical contributions of the study.

In India’s case, three challenges motivated the research: (a) much of the existing literature relies on pre-crisis data sets and ignores recent structural shifts, (b) the interaction between precautionary and mercantilist motives and domestic monetary disequilibrium remains underexplored and (c) adequacy benchmarks are often cited without linking them to econometric evidence or policy trade-offs.

The results provide clear solutions. Imports have a strong negative long-run effect on reserves (elasticity –1.21), showing that trade shocks remain a key vulnerability—thereby updating the evidence base with recent data. Portfolio inflows emerge as a significant positive determinant, confirming their role as both a driver of reserve accumulation and a source of volatility. Most importantly, incorporating money market disequilibrium reveals that reserves are also shaped by internal liquidity imbalances, not only external shocks. This bridges monetary theory with reserve demand and offers a more integrated framework.

Adequacy diagnostics confirm that India’s reserves consistently exceed precautionary thresholds. This implies that a portion of surplus reserves could be redeployed towards external debt repayment or productive domestic investment, reducing fiscal burdens and supporting growth.

The theoretical contribution lies in synthesising competing perspectives. Precautionary motives are extended to include internal disequilibrium, mercantilist arguments are shown to interact with capital flows, and institutional views are advanced by integrating econometric results with adequacy benchmarks. Together, the ARDL–UECM framework demonstrates that reserves are shaped simultaneously by trade, capital mobility and monetary imbalances, and that adequacy analysis provides a theory–policy bridge for determining ‘how much is enough’.

Comparative Perspective: BRICS vs. India

While this study focuses on India, situating the results within a broader BRICS perspective offers valuable insights. The determinants of reserves among BRICS economies reveal both similarities and divergences. For instance, China has historically pursued a mercantilist strategy, accumulating reserves primarily through persistent trade surpluses and managed ER policies (Aizenman & Lee, 2007). In contrast, Brazil’s reserve accumulation has been strongly linked to managing volatile capital inflows, particularly portfolio investments, which parallels India’s positive relationship between FPI and reserves (IMF, 2016). Russia’s reserves have been influenced heavily by commodity cycles, with oil and gas revenues playing a central role (Ocampo, 2013)—a factor less relevant for India, where imports (API) and external debt pressures dominate reserve dynamics. South Africa, on the other hand, has maintained comparatively modest reserve buffers, constrained by structural current account deficits and ER volatility (World Bank, 2020).

In this context, India’s reserve behaviour appears hybrid: like Brazil, precautionary motives against volatile capital flows are important; like China, reserves have exceeded conventional adequacy thresholds; yet, unlike Russia, commodity windfalls are not a driver. This comparative lens underscores that while the BRICS economies share a common interest in building reserves for stability, India’s case is distinctive in combining strong precautionary accumulation with a consistent surplus beyond adequacy benchmarks. This reinforces the study’s conclusion that India’s reserves can be redeployed more productively without compromising external stability.

Policy Suggestions

By 2020, India’s reserves far exceeded conventional adequacy norms: they covered 12 months of imports (against the 3-month benchmark), were more than double the STED and stood above 20% of broad money. This indicates the presence of a substantial surplus buffer. Even a modest redeployment of 10%–20% could ease external debt-servicing costs or finance high-return investments in infrastructure, health and education.

These findings yield several important policy lessons for India’s reserve management strategy. First, the evidence of persistent reserve surpluses relative to adequacy benchmarks suggests that maintaining excessively high stocks imposes fiscal and opportunity costs. A more efficient strategy would be to deploy a portion of surplus reserves towards external debt reduction, thereby lowering the country’s interest burden and improving sovereign creditworthiness.

Second, the results highlight the potential of reallocating reserves to productive domestic investment. Channelling a fraction of reserves into infrastructure, energy security and digital innovation would generate multiplier effects for long-term growth while still preserving sufficient buffers for external shocks. This aligns directly with SDG 8 (sustained and inclusive economic growth) and SDG 9 (resilient infrastructure and innovation).

Third, the significant role of imports, portfolio flows and monetary disequilibrium in shaping reserves underscores the need for integrated macroeconomic management. Policies aimed at stabilising capital flows, managing current account imbalances and deepening domestic financial markets can reduce the volatility that fuels precautionary hoarding. At the same time, strengthening institutional quality and policy credibility would enhance confidence, enabling reserve optimisation without undermining external stability.

Finally, India’s reserve management strategy should be situated within the broader agenda of sustainable development and resilience. By linking econometric evidence with adequacy diagnostics, this study shows that reserves are not merely a financial safeguard but also a developmental resource. Their prudent redeployment can free fiscal space for health, education and climate-resilient infrastructure, directly supporting the SDGs while maintaining macroeconomic stability.

Conclusion

Building on the policy insights outlined above, this section summarises the study’s key findings, theoretical contributions and implications for future research. This study examined the determinants of India’s foreign exchange reserves using quarterly data from 2000 to 2020 within an ARDL–UECM framework. By explicitly incorporating a money market disequilibrium variable, the analysis provided fresh insights into both the long-run and short-run drivers of reserves. The results indicate that imports, foreign portfolio inflows and domestic monetary disequilibrium significantly influence reserve accumulation, with imports exerting the strongest negative effect. Reserve adequacy diagnostics further revealed that India consistently maintains reserves above precautionary thresholds, suggesting the presence of surpluses.

Theoretically, the findings refine the precautionary motive by showing that reserves function not only as insurance against external volatility but also as a corrective mechanism for internal monetary imbalances. They also nuance the mercantilist perspective by highlighting its interaction with capital flows and disequilibrium dynamics, rather than treating it as an isolated motive. Moreover, by integrating econometric results with adequacy benchmarks, the study advances institutional perspectives and builds a bridge between theory and applied policy analysis.

Like all empirical work, this study is subject to certain limitations. The analysis focuses primarily on macroeconomic and monetary determinants, leaving aside political economy factors and global financial integration channels that may also shape reserve dynamics. Future research could extend the framework by incorporating nonlinear effects, comparative evidence across countries and the role of global shocks such as climate risks or technological disruptions.

Acknowledgements

We would like to thank the Department of Economics, University of Kashmir, for their valuable contributions to this study.

Authors’ Contribution

Arjumand Qadir conceptualised and designed the study and conducted data analysis. Mohammed Ayub Soudager contributed to the writing and editing of the manuscript.

Data Availability

The data for the said study have been extracted from:

The complete data sets used during the current study are available from the corresponding author on reasonable request.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

ORCID iDs

Arjumand Qadir  https://orcid.org/0009-0002-9338-2433

https://orcid.org/0009-0002-9338-2433

Mohammed Ayub Soudager  https://orcid.org/0000-0002-4078-2479

https://orcid.org/0000-0002-4078-2479

Aizenman, J., & Lee, J. (2007). International reserves: Precautionary versus mercantilist views, theory and evidence. Open Economies Review, 18(2), 191–214. https://doi.org/10.1007/s11079-007-9030-z

Aizenman, J., & Marion, N. (2003). The high demand for international reserves in the Far East: What is going on? Journal of the Japanese and International Economies, 17(3), 370–400. https://doi.org/10.1016/S0889-1583(03)00008-X

Bahmani-Oskooee, M., & Poorheydarian, M. (1990). The demand for money in open economies: The case of the United States. Economics Letters, 33(2), 185–191. https://doi.org/10.1016/0165-1765(90)90222-P

Bird, G., & Rajan, R. (2003). Too much of a good thing? The adequacy of international reserves in the aftermath of crises. World Economy, 26(6), 873–891. https://doi.org/10.1111/1467-9701.00552

Calvo, G. A. (1998). Capital flows and capital-market crises: The simple economics of sudden stops. Journal of Applied Economics, 1(1), 35–54.

Calvo, G. A., & Mendoza, E. G. (1996). Mexico’s balance-of-payments crisis: A chronicle of a death foretold. Journal of International Economics, 41(3, 4), 235–264.https://doi.org/10.1016/S0022-1996(96)01436-5

Chami, R., Cosimano, T., & Gapen, M. (2008). Beware of emigrants bearing gifts: Optimal fiscal and monetary policy in the presence of remittances. IMF Working Paper WP/08/29. International Monetary Fund. https://doi.org/10.5089/9781451868886.001

Cheung, Y. W., Qian, X., & Remolona, E.(2019). Hoarding of international reserves: It’s a neighbourly day in Asia. Pacific Economic Review, 24(2), 208–240. https://doi.org/10.1111/1468-0106.12297

Chakrabarty, K. C., & Bordoloi, S. (2013). An analysis of India’s foreign exchange reserves. RBI Bulletin, Reserve Bank of India, April 2013.

Chowdhury, M. N. M., Uddin, M. J., & Islam, M. S. (2014). An econometric analysis of the determinants of foreign exchange reserves in Bangladesh. Journal of World Economic Research, 3(6), 72–82. https://doi.org/10.11648/j.jwer.20140306.12

Dominguez, K. M., Hashimoto, Y., & Ito, T. (2012). International reserves and the global financial crisis. Journal of International Economics, 88(2), 388–406. https://doi.org/10.1016/j.jinteco.2012.03.003

Edwards, S. (1984). The demand for international reserves and monetary equilibrium; some evidence from developing countries. Princeton University, International Finance Section.

Ford, J. L., & Haung, G. (1994). The demand for international reserves in China: An ECM model with domestic monetary disequilibrium. Economica, 379–397. https://doi.org/ 10.2307/2554622

International Monetary Fund (IMF). (2013). World Economic Outlook: Transitions and tensions. International Monetary Fund. https://www.imf.org/en/Publications/WEO/Issues/2016/12/31/World-Economic-Outlook-October-2013-Transitions-and-Tensions-40804

International Monetary Fund (IMF). (2016). World Economic Outlook: Too slow for too long. International Monetary Fund. https://www.imf.org/en/Publications/WEO/Issues/2016/12/31/World-Economic-Outlook-April-2016-Too-Slow-for-Too-Long-43718

Jeanne, O. (2007). International reserves in emerging market countries: Too much of a good thing? Brookings Papers on Economic Activity, 1, 1–79.

Kashif, M., & Sridharan, P. (2020). Factors Affecting International Reserves: With Special Reference to Sri Lanka. Pondicherry Central University, School of Management.

Law, C. H., Soon, S. V., & Ehigiamusae, K. U. (2021). The nonlinear impact of institutional quality on international reserves: International evidence. Journal of International Commerce, Economics and Policy, 12(3), 2150014. https://doi.org/10.1142/S179 3993321500149

Mishra, R. K., & Sharma, C. (2011). India’s demand for international reserve and monetary disequilibrium: Reserve adequacy under floating regime. Journal of Policy Modelling, 33(6), 901–919. https://doi.org/10.1016/j.jpolmod.2011.03.005

Nayak, S., & Baig, M.A. (2019). International reserves and domestic money market disequilibrium: Empirics for India and China. International Journal of Emerging Markets. https://doi.org/10.1108/IJOEM-10-2018-0536

Ocampo, J. A. (2013). The macroeconomics of the resource curse. In R. Arezki, T. Gylfason, & A. Sy (Eds.), Beyond the resource curse (pp. 11–39). International Monetary Fund.

Pontines, V., & Rajan, R. S. (2011). Foreign exchange market intervention and reserve accumulation in emerging Asia: Is there evidence of fear of appreciation? Economics Letters, 111(3), 252–255. https://doi.org/10.1016/j.econlet.2011.01.022

Prabheesh, K. P., Malathy, D., & Madhumathi, R. (2007). Demand for foreign exchange reserves in India: A co-integration approach. South Asian Journal of Management, 14(2), 36–46.

Ramachandran, M. (2004). The optimal level of international reserves: Evidence for India. Economics Letters, 83(3), 365–370. https://doi.org/10.1016/j.econlet.2003.11.015

Rodrik, D., & Velasco, A. (1999). Short-term capital flows. [Working Paper No. 7364]. National Bureau of Economic Research. https://doi.org/10.3386/w7364

Appendix A

Table A1. Results of Unit Root Test.

Notes: .png/image(40)__20x17.png) refers to first difference.

refers to first difference.

* and **: Statistically significant at 1% and 5%, respectively.

Appendix B. Stability Diagnostics

Figure B1. CUSUM Test for Long-run Money Demand Function.

Note: The CUSUM statistic remains within the 5% significance band, confirming stability of the estimated coefficients.

Figure B2. CUSUM Test for Long-run Reserve Demand Function.

Note: The CUSUM statistic stays well within the critical bounds, indicating stability of the reserve demand function estimates.

Figure B3. CUSUM of Squares Test for Long-run Money Demand.

Note: The CUSUMQ statistic lies within the 5% significance bands throughout the sample period, suggesting parameter constancy and absence of structural breaks.

Figure B4. CUSUM of Squares Test for Reserve Demand Function.

Note: The CUSUMQ statistic lies within the 5% significance bands throughout the sample period, suggesting parameter constancy and absence of structural breaks.