1 Indian Institute of Management Bangalore, Bengaluru, Karnataka, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

The workings of monetary policy have often been construed as a “black box.” Not only does the nature of transmission channels vary across the economies, the significance and dominance of one channel over another is also a function of the nature and developmental stage of the economy under consideration. In this article, we attempt to understand the different channels of monetary policy operation and study which is(are) the dominant channel(s) in India. Our primary focus then is to identify the different hurdles that prevent the efficient transmission of monetary policy and assess few policy prescriptions to mitigate them. A simultaneous view from the perspective of business-government-society is also taken.

monetary policy, interest rate transmission, channels of monetary operations, interest rate channel, asset price channel, credit channel

Introduction

Monetary policies around the globe have gained a lot more prominence of late. Whether the Great Recession of 2008, the sovereign debt crises of 2013 in Europe, or the latest COVID-induced slowdown across the world, monetary policies have genuinely done some heavy lifting in close conjunction with fiscal support from the respective governments. This has prompted renewed interest in understanding the mechanism by which monetary policies work. The mechanism by which a central bank’s actions, whether through policy rate changes or asset purchase or expectation guidance, affect the real economy is called the transmission mechanism of monetary policy. It is important to note that monetary policies affect real economic variables in multiple ways—many transmission mechanisms. Some of the commonly cited tools include the interest rate channel, asset price channel, credit channel, balance sheet channel, exchange rate channel, and expectations channel.

For a central bank to attain its objectives of price stability, optimum employment levels, and financial market stability, understanding the country’s transmission mechanisms is important. Therefore, it is necessary that the central bank be able to identify the dominant channels of transmission in its country of operation, and then frame policies accordingly to attain its objectives most efficiently. As mentioned before, although the literature has identified multiple transmission channels, the importance and significance of each of them vary across different economies, depending on the concerned economy’s level of development and structure. Our focus in this article would be on the India experience of monetary policy transmission. Various authors such as Mohanty (2012) and Khundrakpam and Jain (2012) have found evidence for multiple channels for policy transmission in India, but the interest rate channel remains by far the dominant one. Having established that, we look at the various impediments to efficient monetary policy transmission such as rigidity in lending rates, availability of alternate sources of investment in bank-dominant economy that impedes a bank’s ability to negotiate deposit rates, and weak bank balance sheets. We propose few solutions also to address these imperfections.

The entire article is organized as follows. We briefly explain different mechanisms and assess the literature review on the same. We then focus on the interest rate mechanism in India and see the methodology adopted to study its effect. The report thereafter identifies some issues that hamper efficient transmission from policy rates to the real economy, and then shed light on the importance of efficient transmission from a business–government–society (BGS) perspective, followed by policy recommendations and conclusions.

Transmission Mechanisms of Monetary Policy

Interest Rate Channel

One of the most written about channels in the transmission mechanism is the interest rate channel. This channel is very intricately related to the IS-LM (investment–savings and liquidity preference–money supply) framework first propounded by the economist Hicks. The central bank through its policy rate changes targets the “short end” of the yield curve. For example, the Reserve Bank of India (RBI) by altering the repo rate targets the rates in the money markets, for example, the weighted average lending rate (WALR) and the call money rate (CMR). The changes in the short end then translate into the longer end of the yield curve. These long-term interest rates affect the investment and the consumption decisions of both households and corporates, leading to changes in aggregate demand and supply, affecting output and price levels in the economy.

To take an example, an accommodative monetary policy stance by the central bank would tend to lower the interest rates in the economy. If it is through an increase in money supply, for the same demand for money in the LM model, a higher money supply will equilibrate the money market at a lower rate. The supply of money is now more significant than the transactional, speculative, and safety-based demand for money. People would want to part with the excess cash, and they would prefer to invest it in bonds, equity, or any other asset market. The rise in demand for these assets would increase their price. The lower interest rates for higher money supply would tend to shift the positively sloped LM curve downward. With lower interest rates, the cost for financing and, consequently, the hurdle rates for investment demand also go down. Thus, the corporates would be inclined to borrow cheaply and invest the proceeds in real assets. Households would also find the rates of borrowing go down. This higher demand stemming from higher investment and consumption would tend to push up the aggregate demand. With aggregate supply not very sensitive in the short term, output and price levels will tend to rise. Thus, to cater to economic slowdowns, the central banks would tend to opt for accommodative monetary policies, ceteris paribus. The exact reverse flow of events will occur for a contractionary monetary policy.

Asset Price Channel

One of the drivers of consumption other than income, utility, demographics, etc. is wealth. Research has shown that given all else equal, people tend to spend more if they perceive that they are wealthier. The corollary for corporations is that they invest more if the asset side of their balance sheet is stronger. As mentioned before, the accommodative monetary policy tends to inflate asset prices. Consider an individual who has his/her wealth invested in bonds and stocks. (The logic stays the same for other assets as well.) Assuming the price of these assets is calculated as the sum of the discounted value of future cash flows, an accommodative monetary policy will tend to lower the interest rates used for discounting. This will tend to push up the prices of these assets. The higher asset prices through the wealth effect will boost consumption and, consequently, aggregate demand. Similar reasoning can be made for corporates, where the lower interest rates will tend to boost demand for investment through the asset side of the balance sheet. If the borrowing comprises floating rate loans, the interest paid on these loans will decrease as the rates in the economy fall. This would boost the net worth of the firms. As a side note, the firm can also choose to refinance its old high-interest debt with low-interest rate debt when interest rates fall.

Credit Channel

Whereas the neoclassical channels of monetary policy transmission operate through an effect on consumption and investment, the non-neoclassical channels operate through market frictions. A dominant channel where market frictions operate is the credit channel. Banks are uniquely positioned to handle the problem of asymmetric information in channeling saved funds to those lent. In the case of accommodative monetary policy, the number of funds available with banks increases. For example, a reduction in the Cash Reserve Ratio would tend to free up funds locked with RBI. Banks would then lend these funds to borrowers after doing requisite credit appraisal. The jury about the dominance of this channel in policy transmission is divided. Given all else equal, a bank-dominated economy can be expected to have a strong influence of the credit channel in the transmission mechanism. In many emerging market economies, many of the firms do not have access to direct financial markets. These firms then rely on the banks who help in the intermediation of funds between borrowers and savers. Thus, one can expect the credit channel to play a dominant role in emerging market economies, given their heavy reliance on banking institutions over financial markets.

Balance Sheet Channel

This channel was briefly touched upon in the explanation for the asset price channel. It works in close conjunction with the asset price channel. A stronger balance sheet increases the propensity of both households and corporates to increase consumption and investments, respectively. The balance sheet channel also influences the credit creation mechanism in the economy. India recently faced a twin balance sheet problem. The twin balance sheets belonged to corporates and the banks that lent to them. A deterioration in the corporate balance sheet, either due to malfeasance or exogenous shocks on business projections, makes it difficult for corporates to service the interest and principal payments on the loans they have borrowed from banks. With interest and principal payments from corporates drying up, banks had to recognize their then standard assets as nonperforming assets (NPAs). (The practice of evergreening was prevalent in the Indian scenario before RBI strengthened the disclosure and NPA recognition norms after Asset Quality Reviews [AQRs]). Higher NPAs can severely restrict a bank’s ability to lend to corporates, thus constraining the credit supply in the economy. We discuss this friction later in issues relating to the effective transmission of monetary policy.

Exchange Rate Channel

The national output is found by aggregating domestic consumption, investment, government expenditure, and net exports. The net exports, which equal exports less imports, are influenced by the exchange rate of the country. If the monetary policy is accommodative, the domestic interest rates tend to fall with respect to foreign interest rates. The opportunity cost logic then makes a case of divesting domestic assets, and then importing the proceeds in foreign ones. This leads to the depreciation of domestic currency as investors move out their wealth to foreign assets. The depreciation of currency makes the value of domestic goods cheaper relative to their foreign counterparts, ultimately pushing up the exports. The exact reverse case occurs for imports. In a country like India, a rupee depreciation tends to weaken the current account balance by increasing the bill paid for crude oil and gold, the country’s largest imports. The extent to which the movements in exchange rates tend to influence consumption depends on the exchange rate pass-through possible. The exchange rate channel will likely have more influence on the monetary policy transmission for open economies than for closed ones.

Expectations Channel

The great financial crisis exposed the limitations of traditional channels of monetary policy transmission. With rates already at rock bottom, the effect conventional monetary policies could have had in propping up the aggregate demand and warding of deflationary pressures was minimal. A channel that gained prominence and has become a point of research interest is the expectations channel. This channel operates through the kind of expected participants in the economy form about future central bank actions and the consequent impact on macroeconomic variables. For example, if the central bank targets monetary easing as long as the inflation does not reach its target zone, the market participants can expect accommodative policy that flows through the interest rate and asset price channel to continue flowing. The participants then adjust their expectations accordingly. An important example of the expectations channel at work is the adoption of inflation-targeting regimes by most of the major central banks around the world. Needless to state, the extent to which this channel can have an influence on the monetary policy transmission is heavily influenced by the credibility the central bank enjoys in the country of its operation.

We have briefly discussed the channels of monetary transmission that operate in an economy. It is also important to realize that these channels are not mutually exclusive and often tend to operate in close conjunction with each other. This creates an empirical issue for researchers as the available techniques in econometrics make it very difficult to ascertain the exact contribution of a particular channel in the entire transmission process. The second thing to note is that the influence these channels have on transmission policies is decided by the structure and the development of the economy wherein they operate. As the economy develops over time, the dominance of one channel might reduce in favor of another one.

Literature Review

We now discuss the literature published on the monetary policy transmission mechanism across economies. The previous section talked about the various mechanisms on monetary policy transmission across economies. We now turn to check the evidence for them in this section. The literature review spans across economies.

Tobin (1969) explained the traditional interest rate channel operating through the user cost of capital and portfolio choice—Tobin’s q theory. It suggests a mechanism through which monetary policy interacts with the economy and makes an impact on the valuation of equities. Tobin’s q is defined as the market valuation of all the firms divided by the replacement cost of capital. If q > 1, then equity valuations are higher than the cost of investment in assets. Thus, it is cheaper to raise funds via equity for corporates relative to the cost of assets. Therefore, investment in capital assets will rise. Thus, during periods of expansionary monetary policy, the money supply is higher due to lower availability of capital, and therefore, these funds in the chase of higher returns move to equity assets.

Bernanke and Blinder (1988) highlighted whether the monetary policy can affect the bank lending channel, that is, the supply of credit by the banks in the economy. Their model suggested that the open market operations by a central bank drain out the reserves and deposits out of the banking system. This limits the supply of money available with the banks to lend. The model was based on the assumption that banks cannot replace retail deposits with other sources of funds like equity issuance. Thus, this assumption may not hold true today.

Romer and Romer (1990) assessed two theories of the monetary policy transmission mechanism through bank lending rather than transaction balances. These two theories are: first, “money view theory,” where the asset side of the bank’s balance sheet plays no role in the interest rates; and second, “lending view theory” which suggests that in order to lend to potential borrowers, banks need money; hence, this derives the demand for reserves. Thus, more creditworthy customers lead to higher demand for reserves, which leads to competition among the banks for deposits, further leading to increasing interest rates. To summarize, the asset side of the balance sheet drives the interest rates. However, their paper concluded that the impact of monetary policy on interest rates is likely to operate largely through bank liabilities rather than bank assets on the basis of the evidence that monetary policy has a stronger impact on transaction balances since reserve requirements on such balances are higher.

Taylor (1995) undertook research to review the impact of monetary policy transmission on real GDP and prices using a financial market framework. This framework highlighted the role of monetary policy in determining prices and rates of return on financial assets, interest rates, and exchange rates which influence the spending decisions of firms and household stakeholders. Taylor identified under the financial market view that the traditional interest channel is important for monetary policy transmission to the real economy.

Obstfeld and Rogoff (1995) emphasized on the importance of the exchange rate on the monetary policy transmission. Their paper suggested that reducing domestic inflation and the instability caused by it can be managed and addressed better through the central bank’s basic reform of monetary policy mechanisms. Co-ordinated monetary policy is important to manage extreme events of crisis like the global stock market crash. Even in such cases, it is wrong to consider that these efforts will automatically lead to exchange rate stabilization. The exchange rate should be used as an indicator and not as the core focus area for monetary policy.

Monetarists (classical economists) favors rules for monetary policy to reduce the costs of acquiring information. Without such rules, market players need to anticipate how and when the policymakers would respond to price, output, employment, and other changes. Such rules would reduce the uncertainty and wrongful perceptions that increase the volatility in relative prices and real wealth. Following are the five rules:

Meltzer (1995) also proposes that knowledge of the transmission process does not remove uncertainty about the nature of impulses or their resultant impacts on the economy.

Ramey (1993) tried to address the relative importance of the money and credit channels in the transmission of monetary policy. In both the money and credit view, the process starts when the policymakers change the ability of banks and lending institutions to function by altering either reserve requirements or level of reserves. The method used by the central bank to alter the reserves is controversial. It concludes with evidence that the money channel is more important than the credit channel in the direct transmission of policy impulses—the marginal effect of bank loans on industrial production.

Bernanke and Gertler (1995) tried to find the importance of the credit channel in monetary policy transmission. Monetary policy actions are followed by the movements in real output lasting for two years or more. However, the research does not comment on what happens in the economy till the effects in the real economy kick in. There are many gaps in the way conventional monetary policy works. One, the interest-sensitive components have not been able to identify the important effect of neoclassical cost of the capital variable (lagged output, cash flows, or sales). Rather, these factors have a greater effect on spending. This suggests a weaker cost of capital effect in forecasting the spending equations. Second, there is a presumption that monetary policy should have a larger effect on short-term interest rates (federal funds rate) and a lower impact on longer term interest rates. Surprisingly, the contrary is true where the monetary policy has larger effects on assets purchased, which are sensitive to long-term rates (residential assets, plant, and equipment). Three, the credit channel theory suggests that the direct effects of monetary policy on interest rates are increased by internal changes in the external finance premium, which is the difference in cost of funds raised internally (retained earnings) and cost of funds raised externally (equity). There is a positive correlation between the interest rates in the economy and the external finance premium, that is, the increase or decrease in interest rates leads to an increase or decrease in the external finance premium. This leads to a magnified and larger effect of monetary policy on the borrowing cost. The article also describes two channels between central bank actions and the external finance premium: the balance sheet channel and bank lending channel. The former focuses the impact of policy actions on the borrowers’ balance sheets and income statements, including net worth, cash flows, and personal assets of the borrowers. The latter stresses on the effect of monetary policy changes on the supply of loans by lending institutions (banks). They also suggest that the bank lending channel is controversial while the existence of the balance sheet channel is established.

Mohanty (2012) and Khundrakpam and Jain (2012) analyzed the transmission mechanism in India. Both concluded the significance of the interest rate channel from their respective studies. We analyze both in depth now.

Further, Mohanty (2012) tried to find how monetary policy changes affect different markets (money markets, debt markets, credit markets, foreign exchange markets, and asset markets) in India and uses the structural vector autoregression (SVAR) model to find evidence for the interest rate transmission mechanism in the Indian context. In the work, Mohanty posits first that with increasing deregulation and deepening of markets post reforms of the 1990s, the impact of monetary policy would be felt across markets. To test this hypothesis, Mohanty (2012) carry out Granger’s causality tests based on the VAR framework. Monthly data from April 2001 to March 2011 are taken. The entire data are divided into two groups: policy variable (CMR) and proxies for other markets—10Y government bond, WALR, 5Y AAA-rated bond yield, Sensex, and USD–INR rate. These rates serve as the proxy for the respective asset markets mentioned above. The results showed causality in both directions. The article also tested whether there was an equilibrium across markets. The results for Johansen’s cointegration test and the causality tests have been summarized in the supplemental material of this article. The results implied that changes in monetary policy are reflected across different markets.

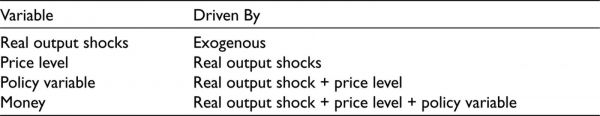

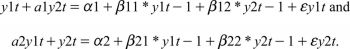

To test the impact of policy variable changes on GDP, money, and price levels, SVAR tests were also carried out. The model by Mohanty (2012) assumes the following relationships (Table 1).

The results conclude that the policy variable is negatively related to the GDP growth rate. The maximum decline occurred with a lag of approximately two quarters, and the impact persisted through 6–8 quarters. The policy variable also had a negative effect on the price level. The lag and persistence numbers were at 3 and 8–10 quarters, respectively. From a causality perspective, Mohanty (2012) found that there was a two-way causality from macroeconomic variables to policy rate and vice versa.

Similar research to understand the transmission process in India was carried by Khundrakpam and Jain (2012). Their aim was to identify the different channels at work in the transmission process. They included external variables to account for external influence. They constructed a baseline model with both exogenous and endogenous variables, and then resorted to the selective switching on/off mechanism to identify the influence of different channels in the transmission process. The endogenous variables included GDP, price level, and policy rate, whereas the exogenous variables included world GDP, world commodity price index, interest rates in major economies, and portfolio inflows at gross levels. The rationale for including external variables was to account for the fact that as the Indian economy liberalized, the impact of what happened outside India was felt increasingly on the Indian economy and consequently monetary and fiscal policies.

Table 1. Relationships Between the Economic Variables as Assumed by Mohanty (2012)

They found that with a positive shock in the CMR, a decline in GDP was observed at Q2 and Q3 with and without exogenous variables included. The inflation also shows a similar trend with the peak impact observed at a lag of one quarter with respect to GDP growth. They also found that including exogenous variables prolonged the impact of a change in the CMR. The graphs in the supplemental material show the response functions described above.

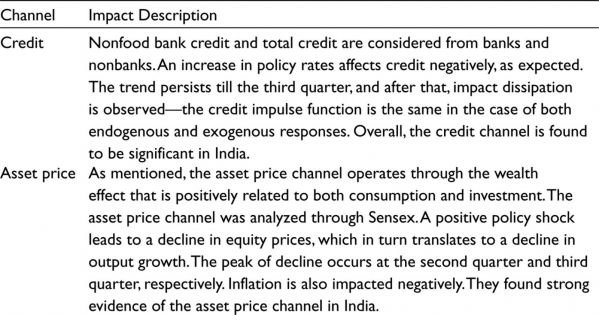

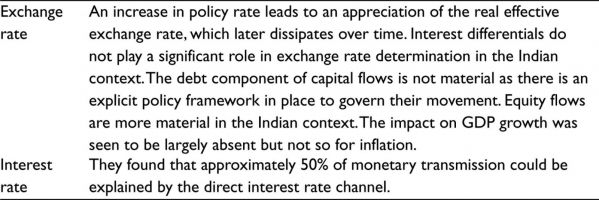

The impact of other channels on the transmission of monetary policy is summarized in Table 2.

Table 2. Summary of Significance of Different Transmission Channels as Analyzed by Khundrakpam and Jain (2012)

In essence, Khundrakpam and Jain (2012) found that the direct interest rate channel, asset price, and credit channel had a significant impact on GDP growth rates and inflation. Exchange rate impact, on the other hand, did not have a significant impact on output growth, albeit it was as good as it was absent. It had a good impact on inflation, nevertheless. The impulse response functions as documented by Khundrakpam and Jain (2012) have been made available in the supplemental material of this article.

Having discussed the literature and empirical evidence of transmission channels in India, we now discuss the methodology adopted in this work to study the impact and significance of monetary policy transmission channels in an economy.

Methodology

Whether a monetary policy should be accommodative or contractionary depends on how various economic variables such as price level and GDP are faring at a given point of time with respect to the tolerance level set by the central bank. If the price level is trending near the upper band of permissible limits with output consistent with full-employment levels, the central bank might think of raising policy rates to prevent inflation from creeping in. An important point to note here is that not only are these variables dependent on their own values in the past, but also on how other variables have fared in the past and present. For example, the price level in the economy is a function of both previous price levels and the level of output generated.

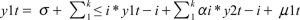

To test the impact of policy rates on various economic parameters such as price levels and GDP, researchers of monetary policy frequently use vector autoregression (VAR) models. The word autoregressive means that the dependent variables under consideration are a function of the lagged values of the same, whereas the presence of “vector” implies that there are more than two variables at play here. All the variables in the VAR system are endogenous, and the stochastic error terms in the model signify any kind of shocks or impulses to this system of variables. Mathematically, this system can be expressed in the following way:

(1)

(1)

(2)

(2)

where y1t and y2t are two dependent variables that are a function of each other and their lagged values. In the above case, lags up to k time periods have been considered; hence, the model is denoted as VAR (k).

An offshoot of the VAR model is the SVAR model. SVAR helps us identify purely exogenous shocks to be able to trace out their dynamic effects on our system of variables. In the case of monetary policy, it helps us identify how an exogenously driven change in monetary policy affects variables of interest such as GDP and price levels. The process of determining the SVAR model is called the identification of SVAR.

Consider the SVAR (1) model as follows:

(3)

(3)

where the error term captures the independent shocks.

Thus, in the above model, the value of a time-series parameter is a function of its lagged value, current value, and the external shock that it receives in time t. It should also be noted that the term X is a vector and captures the two underlying variables y1 and y2. The above equation can be expanded as follows:

The structural VAR is estimated after it is converted to its reduced form. This is obtained by multiplying Equation (3) by the inverse of matrix A. The reduced form is written as follows:

The above equation has six coefficients that we need to estimate (two in G0 and four in G1). We now turn to the issues that impede the efficient transmission of monetary policy in an economy. The focus here as well is on the Indian context.

Issues in Transmission

The efficacy of transmission has always been a topic of active research interest—the question of how efficient the transmission in the Indian context comes into light in 2019. RBI had reduced policy rates by 135 basis points from February 2019 to January 2020, but the degree to which prices and rates in different markets changed differed. We refer to the RBI working paper here, which succinctly highlights the various issues in transmission. This section discusses the impact of policy rate changes on money and bond markets and the credit market intermediated by banks.

Rigidity of Lending and Deposit Rates

With respect to money and bond markets, the transmission was pretty much quick and complete. It was seen that with a 135 bps cut in the repo rate, the decline in 3M T-bills and 3M CD were 144 ads and 167 bps, respectively, whereas the reduction in 3M CPs by NBFCs and non-NBFCs were 190 and 140 bps, respectively. The corporate bond spreads held their earlier values more or less as well. Along the yield curve, the transmission was much more efficient at the lower end than the farther one, driven primarily by rating downgrade of a few NBFCs and balance sheet concerns of some banks. RBI (2020) paper also computed the correlations across policy rates and rates across money and bond markets (see Supplemental Material). The correlations were found to be statistically significant. An interesting pattern that was seen was that the coefficient of the repo rate that explained the impact on the dependent rate in regression analysis decreased as the tenor of the dependent rate increased. The paper concluded that factors other than the repo rate likely had an impact on rates farther down the yield curve (see Supplemental Material). Concerning the deposit and lending rates, the case is different.

A bank acts as an intermediary for channelizing the funds between savers and borrowers. In doing so, it promises savers interest income guaranteed through deposit rates. It earns this interest income from the loans it makes to the borrowers. The spread, the difference between lending and deposit rates, is how a typical bank makes money. Fee income is excluded here for analysis purposes. The spread helps banks pay for their overheads, management expenses, and profits to shareholders. In the Indian context, banks price loans based on the cost of funds they incur in securing deposits or borrowing from markets. RBI has allowed banks to arrive at their cost of funds using internal methods.

With the deposit rate fixed, the sensitivity of the change in deposit rates and, consequently, the cost of funds to changes in policy rates are low. Only when the deposits rates are contracted again, the cost of funds will change. This change then reflects in the rates banks charge to borrowers. In the case of foreign banks, with the tenor of the majority of deposits lesser than a year (see Table 3), the flexibility these banks get in changing deposits rates when policy rates change is higher. Thus, we can see that foreign banks have been the most proactive in reducing rates on both their deposits and loans. This stickiness of deposit rates to changes in policy rates is not symmetric in nature. If the policy rate increases after a monetary policy action, the depositors renew their deposits at a higher rate. The banks have to be sensitive to these changes as corporate deposits, which are bulky in nature, are highly proactive in deposit shopping. Thus, in the case of a policy rate increase, the deposit rates go up a lot more quickly, and this gets reflected in the higher cost of funds which is then passed on to borrowers in terms of higher lending rates.

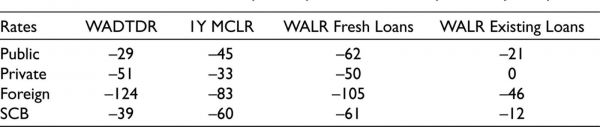

Table 3. Changes in Bank Rates (Lending and Deposit) Across Public, Private, Foreign, and SC Banks Post Reduction in Policy Rats by RBI from February 2019 to January 2020

Source: RBI: Monetary Policy Transmission Trends in India—Recent Trends and Impediments (2020).

However, in the case of a reduction in policy rates, the same process would not work. The depositors would want to earn higher rates of return on their deposits and hence would not be proactive in renegotiating with banks. Under the marginal cost of the funds-based lending rate (MCLR) system, the tenor is 1 year, whereas the weighted tenor of deposits is 2 years (RBI, 2020). So, after a reduction in policy rates, only 50% of the deposits are repriced at newer rates. Thus, the MCLR does not come down as much as the central bank would expect. This lack of reduction then reflects in lending rates remaining sticky to their then existing levels.

As mentioned before, the transmission in banks has not been complete. To check the effect on deposit and lending rates, the authors have considered a weighted average domestic term deposit rate (WADTDR) and the WALR. WADTDR declined cumulatively by 32 bps during the entire easing period, mainly expedited post introduction of floating rate loans for micro, small, and medium enterprises (MSMEs), whereas the WALR decreased by 61 bps and 12 bps, respectively, on fresh and existing loans. At the bank level, the response has not been uniform. The maximum decline in WADTDR, 1Y MCLR, and WALR on fresh and existing loans has occurred for foreign banks, followed by public and scheduled commercial banks, and then for private banks. Table 3 summarizes the impact across the rates for different banks.

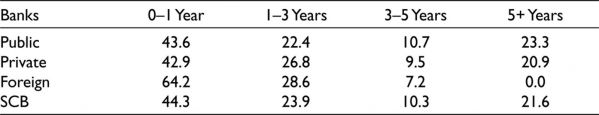

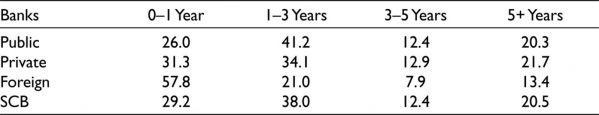

In order to understand the reason for this diverse response, it is necessary to analyze the maturity structure of both the loans and deposits. RBI (2020) does a great job in displaying the same, the results for which are concluded below (Table 4 and Table 5).

Table 4. Deposit Profile—Bank Type (%)

Source: RBI: Monetary Policy Transmission Trends in India—Recent Trends and Impediments (2020).

Table 5. Loan Profile—Bank Type (%).

Source: RBI: Monetary Policy Transmission Trends in India—Recent Trends and Impediments (2020).

Looking at the loan and deposit tenor profile, we can see that foreign banks have most of their deposits and the loans concentrated in the 0–1 year bucket. Their involvement in the lending pie decreases as the tenor increases, picked up by public and private banks. As can be inferred, the lower tenor in both deposit and lending contracts affords foreign banks the flexibility to ensure better pass through of policy rate reduction. The underlying fact here is that whereas the lending rates on loans are flexible, the deposit rates contracted are fixed in nature.

Rigidity of Savings Rate

The second issue that props up is the rigidity of the savings rate. The savings deposit rate has remained steady despite deregulation by RBI in 2011 (see Supplemental Material). According to a calculation done by authors in RBI (2020), assuming savings deposits constitute 30% of total borrowings, a 25 bps reduction in the repo rate would only lead to a decline of 14 bps in MCLR. This rigidity in the savings deposit rate also results in MCLR being less sensitive to changes in repo rates.

Attractiveness of Alternate Investment Opportunities

A third but very related issue is the attractiveness of alternate investment opportunities like mutual funds and small savings schemes. With increasing financial literacy and the proliferation of SIP schemes, many people are now parking a part of their wealth with mutual funds. The assets under management for mutual funds increased from 11.7% of aggregate AUM, bank deposits, and small savings in 2012–2012 to 31.6% in 2017–2018 before settling on 15.4% in 2018–2019 (see Supplemental Material). For the small savings scheme, the interest rate is administered by the Government of India. These rates are linked to yields on G-secs of maturities in line with the savings scheme under consideration. As RBI (2020) argues, the rates on small savings schemes were higher by 81–160 bps than the formula calculated ones. In essence, the rates are not changed as dynamically as they ideally should have been if they were purely determined by the formula. A reason that has been commonly touted is that in the absence of any social security system in India, the savings scheme interest serves as a source of income for the elderly. Although this rigidity does provide income for the elderly, it also keeps the market for funds lent and funds saved from reaching an equilibrium. High rates on saving scheme can result in real borrowing rates kept artificially high during a cycle of accommodative monetary policy and prevent a lot of investments/consumption demand from picking up.

Weak Bank Balance Sheets

The fourth issue that has been highlighted is the weakness in bank balance sheets. Banks are required to set aside a portion of their profits as capital to cover for any losses on their lending portfolio. The Indian banks recently have been through a period where they have seen their NPAs rising. With the serviceability of many loans going bad, banks are reluctant to reduce their interest rates on loans. The high rates of loans that are nondelinquent provide income to banks, which can they use to beef up their provision buffers. Also, as Raj et al. (2020) concluded, banks were able to pass the burden of NPAs to lending rates when the NPA ratios were low. But as the ratios went up, banks became conservative and reduced their loan exposure. In essence, a healthy balance sheet helps banks pass on the effect of a monetary policy change more efficiently than when otherwise.

To sum up, rigidity in deposits, lending rates, increasing attractiveness to alternate opportunities for individuals to park their funds, the stickiness of interest rates on small savings schemes, and weak balance sheet of banks have all resulted in impeding the efficient transmission of monetary policy in India. It is very important to address these issues effectively as a weakly impactful monetary policy has adverse effects on the three main participants in the economy: businesses (B), government (G), and society (S). The discussion from the BGS perspective can be found in the supplemental material of this article. The following section discusses the policy prescriptions we have suggested to the problems mentioned above.

Policy Recommendations

The following recommendations can help enhance the effectiveness of monetary policy.

Conclusion

This article discusses different mechanisms of monetary policy at work: interest rate channel, asset price channel, exchange rate channel, expectations channel, balance sheet channel, and credit channel. The mechanism most dominant in a country is the function of the level of economic development and structure of the economy. Although we have evidence for various mechanisms at work, the jury is out on which on is the most dominant for India. We have specifically focused on the interest rate channel here in this article.

The article also discusses various impediments to the efficient transmission mechanism. Some of the impediments in the Indian scenario include the rigidity of lending rates driven by sticky deposit rates, weak balance sheets of banks, and the availability of alternative sources of investments such as mutual funds and small savings scheme. We also discuss the need for an efficient transmission mechanism from business, government, and societal perspectives considering the importance of the impact monetary policy has on the real economy. We conclude the article by offering potential policy recommendations that have the potential of improving the transmission mechanism in the country.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

Supplemental Material

Supplemental material for this article is available online.

Bernanke, B. S., & Blinder, A. S. (1988). Credit, money, and aggregate demand (NBER Working Paper No. w2534).

Bernanke, B. S., & Gertler, M. (1995). Inside the black box: The credit channel of monetary policy transmission, Journal of Economic Perspectives, 9(4), 27–48. https://doi.org/10.1257/jep.9.4.27

Khundrakpam, J. K., & Jain, R. (2012). Monetary policy transmission in India: A peep inside the black box (MPRA Paper 50903), University Library of Munich.

Meltzer, A. (1995). Monetary, credit and (other) transmission processes: A monetarist perspective. The Journal of Economic Perspectives, 9(4), 49–72.

Mohanty, D. (2012, August 12). Evidence of interest rate channel of monetary policy transmission in India. RBI Working Paper Series No. WPS (DEPR): 6/2012.

Obstfeld, M., & Rogoff, K. (1995). The mirage of fixed exchange rates. Journal of Economic Perspectives, 9(4), 73–96. https://doi.org/10.1257/jep.9.4.73

Raj, J., Rath, D. P., Mitra, P., & John, J. (2020). Asset quality and credit channel of monetary policy transmission in India: Some evidence from bank-level data. RBI Working Paper Series No. WPS (DEPR): 14/2020.

Ramey, V. A. (1993). How important is the credit channel in the transmission of monetary policy? (NBER Working Paper No. w4285).

Romer, D. H. (1990). New evidence on the monetary transmission mechanism. Brookings Papers on Economic Activity, 21(1), 149–214.

Taylor, J. B. (1995). The monetary transmission mechanism: An empirical framework. Journal of Economic Perspectives, 9(4), 11–26. https://doi.org/10.1257/jep.9.4.11

Tobin, J. (1969). A general equilibrium approach to monetary theory. Journal of Money, Credit and Banking, 1(1), 15–29. https://doi.org/10.2307/1991374

Web Resources

https://www.bis.org/publ/qtrpdf/r_qt1503h.pdf

Monetary policy in India by Rakesh Mohan (BIS Paper No. 35).

Evidence of Interest Rate Channel of Monetary Policy Transmission in India, RBI Working Series Paper (2012)

Monetary Policy Transmission in India – Recent Trends and Impediments, RBI Working Paper

Zhou Xiaochuan: Some considerations in the study of monetary policy transmission, Speech by Mr. Zhou Xiaochuan, Governor of the People’s Bank of China, Beijing, 13 April 2004

The Monetary Transmission Process: Recent Developments and Lessons for Europe, Deutsche Bundesbank

The monetary transmission mechanism in the United States: some answers and further questions, Kenneth N Kuttner and Patricia C Mosser, Federal Reserve Bank of New York

The transmission mechanism of monetary policy in a stabilizing economy: notes on the case of Brazil, Francisco L. Lopes

Winners and Losers from Monetary Policy, Renee Haltom, Federal Reserve

https://www.fool.com/retirement/2018/11/29/heres-how-the-federal-reserve-can-affect-social-se.aspx